How metrics make you pay

January 30, 2019

Are dividends safe? The pay-out-ratio

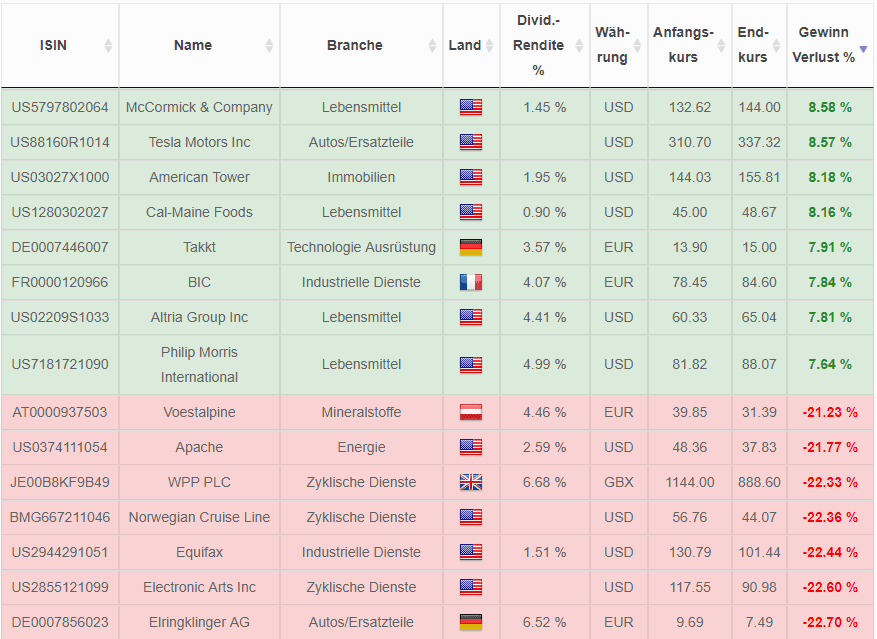

February 3, 2019After the worst December on the US stock market since the Great Depression of 1931, the succeeding January was the strongest since 1987 with an S&P 500, which increased by 7.9%. In January, the stock price had to rise by more than 26% for a stock to make it into the top 15 winner's list. For comparison: in December a modest 3.5% was enough.

With the losers, of course, it's the other way around. Henkel's ordinary stock is already one of the losers with a minus of just under 7%. In December, this would have required a capital loss of more than 23%.

Why the winners are not necessarily a good investment

One might think that stocks with a price gain of over 25% are automatically a good investment. But that’s far from being the case, as I’ll show you below with a few examples.

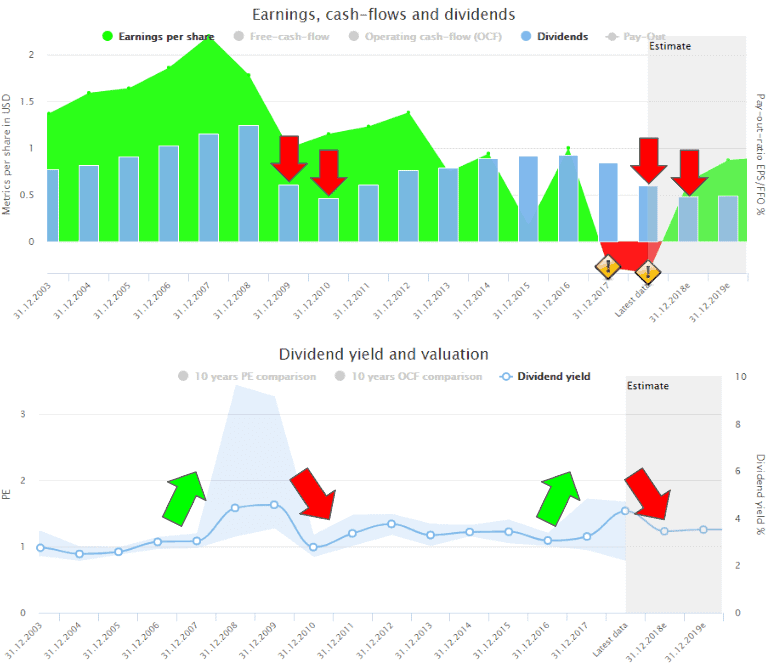

With a capital gains of around 34%, General Electric is in fourth place. Finally, the quarterly figures turned out better than expected or feared – and not vice versa. It remains to be seen whether this will put an end to the shareholders’ years of suffering. There have been two dividend cuts in the last 10 years. Those who were blinded by the rising dividend yields in the wake of falling stock prices had to pay dearly for it.

General Electric: Both dividend cuts preceded rising dividend yields

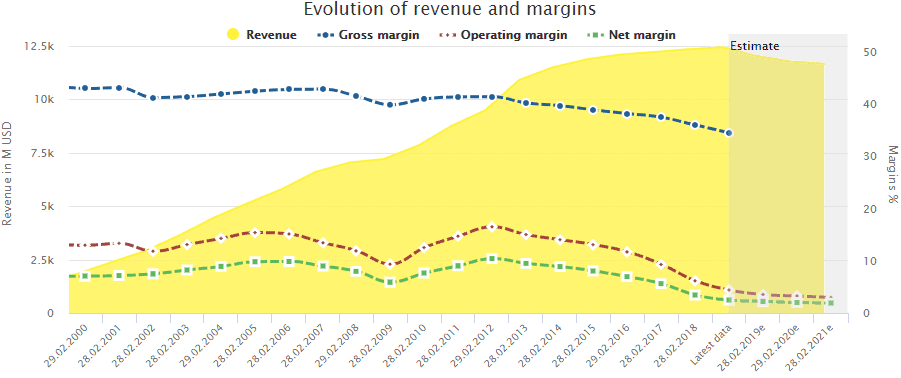

Another problematic case among the winners of the month is Bed Bath & Beyond. Despite capital gains of 33%, the stock has been going down for years. Since 2013, the margins have been falling together with the stock price into the bottomless. A dividend yield of more than 4% only compensates to a very limited extent.

Bed Bath & Beyond: Declining margins and stagnating revenues

Among the winners are Facebook and Netflix, two FAANG stocks, both of which lost heavily in the second half of the previous year. After the poor quarterly figures of Facebook in July last year, I had warned supposed bargain hunters at a price of around USD 175 against buying it. In the months that followed, the price plummeted to USD 125. BTW: On 22nd of December I produced a video on YouTube asking: FAANG stocks – Time to buy the dip?

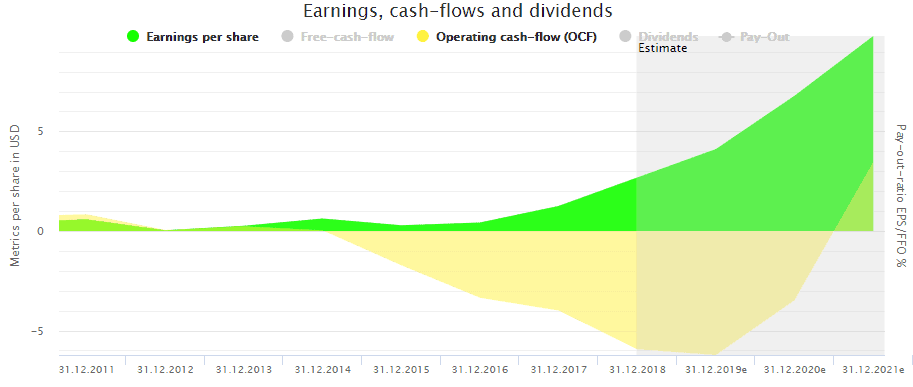

Netflix, on the other hand, is an ongoing controversial issue, as the company burns massive amounts of money despite positive earnings.

Netflix Stock - Negative Cash-Flows Despite Positive Earnings

Conclusion

The examples show that just because a stock price rose does not mean that the stock is automatically a good investment. Because price jumps are relative. In extreme cases, company figures simply turn out less badly than feared, but the company is still on the decline. In fact, extreme price movements in one direction or the other only have a very limited significance for the long-term prospects of a stock. Instead of concentrating on price volatility, it is advisable to focus on long-term profits, as DividendStocks.Cash does.