Tencent Stock – Chinese Dragon For Your Portfolio?

May 11, 2020

Income Heroes – Passive Income – It has never been easier

May 17, 2020Visa is a very popular stock. In 2019 alone, the stock price has risen by 45 percent, clearly outperforming the S&P 500 with a 29 percent increase in the same year. As a result, Visa is now trading at a quite lavish P/E ratio of 32. In this analysis you will find out why I still consider the stock a good investment.

| Visa Stock | |

| Logo | |

| Country | USA |

| Industry | Finance |

| ISIN | US92826C8394 |

| Market Capitalization | 382,4 Milliarden € |

| Dividend Yield | 0.6% |

| Dividend Stability | 0.95 von max. 1.0 |

| Earnings Stability | 0.95 von max. 1.0 |

The business model: This is how Visa makes money

Visa makes money for its shareholders by processing payments worldwide. Although Visa is known for credit cards, many people may not be aware that the company itself does not issue cards. Instead, Visa sells licenses to issue its cards to banks, which then issue them to their customers. So, the interest rates and fees are set by the respective banks, not by Visa. It is also important to note that Visa itself does not grant credit. Only the banks grant credit. Visa therefore does not earn money from the interest payments and fees of the credit cards.

The actual business model of Visa is slightly more complex. Visa acts as a middleman between the customer’s bank and the merchant’s bank during a credit card payment. The following figure shows the payment process, which begins at the merchant with a request to Visa. Visa forwards the inquiry to the buyer’s bank (card issuer), which then pays for its customer. If the request is confirmed, the merchant’s bank (acquirer) is informed of the authorized payment and the acquirer collects the money from the customer’s bank (card issuer).

Source: https://developer.visa.com/legacy/products/vacp

Visa is therefore an intermediary between banks during a payment made by credit card. Visa charges the banks for processing payments without any money flowing through Visa’s accounts. Although this means that Visa does not receive any interest payments, it has a secure and stable source of income through fees based purely on the volume of transactions.

How profitable is Visa?

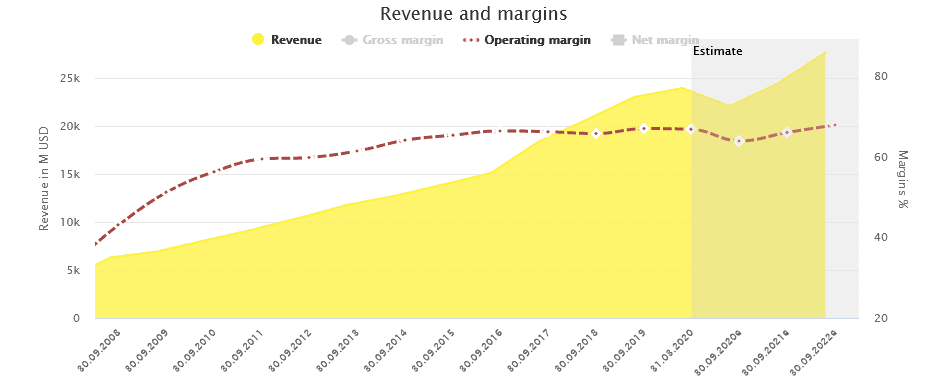

Due to the business model of payment processing, Visa keeps its costs low, resulting in very high margins. The concept is also highly scalable. As a result, margins can be maintained even with increasing sales. This ensures steadily rising profits.

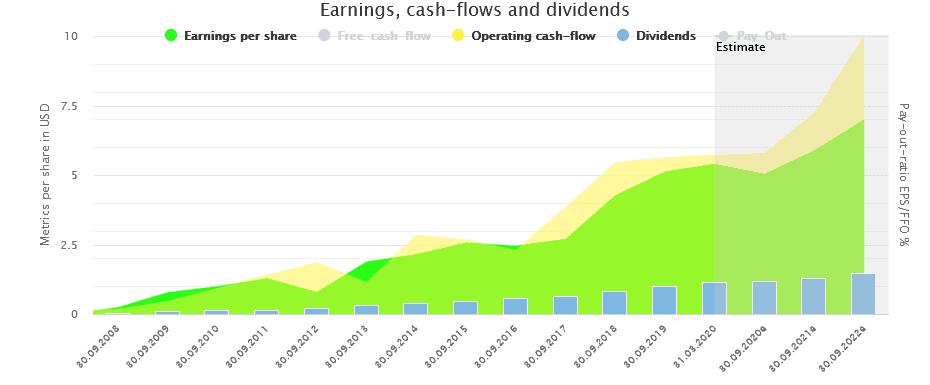

If you look at the development of profits, the rapid rise in prices makes perfect sense. Sales have risen sharply over the years. Over the last ten years by an average of 12 percent annually. As a result, earnings per share and operating cash flow have risen continuously. These increases come from the aforementioned increase in turnover and from share buybacks. Many companies use profits to buy back their own stocks. This reduces the total number of outstanding shares, which increases the profit per share allocated to each individual share. Of course, higher profits and cash flows also allow higher dividends to be paid. As a result of this enormous growth, Visa has been able to report an average dividend growth of 25 percent over the last 10 years.

The main reason for the strong profit growth is the enormous increase in revenue in conjunction with an increase in the operating margin. The operating margin, also known as EBIT margin, expresses the share of operating profit in sales. The operating profit is the profit that remains after all operating costs, such as personnel costs, advertising and other administrative costs have been paid. Between 2010 and 2020, Visa has increased this margin by 11 percentage points. It now stands at an impressive 67 percent. So you can see at a glance that Visa has very low costs and most of the revenue is left as profit. The net margin is 50 percent. This means that 50 percent of the turnover reaches the shareholders as profit after interest and taxes have been deducted from the operating profit. This makes the sales growth extremely valuable, as a very large part of the additional sales actually reaches the shareholders’ pockets.

Is the Dividend safe?

Like most US companies, Visa pays its dividends on a quarterly basis. This currently results in a total annual amount of USD 1.15. At the current stock price of USD 185, however, this only represents a dividend yield of 0.62 percent:

Why is the dividend so low? The first reason for the low dividend yield is the high valuation of the stock. The dividend yield decreases when the stock price increases. Although there is no “normal P/E ratio”, 15 is often seen as a healthy middle ground for many companies. If Visa were to be traded at this P/E ratio, the dividend yield would already be twice as high, at over 1 percent.

Another reason for the low return is the fact that Visa uses only a small part of its profits for dividend payments. The so-called payout ratio indicates the share of profit/free cash flow that is distributed to shareholders. At Visa, this is currently around 21 percent. That is very low. Most companies pay out about half to two thirds of their profits. Here you can see that Visa still has a lot of potential to further increase the dividend by simply paying out a larger portion of the profit. In the chart below, you can see that with almost $12 billion in free cash flow, Visa has only used about $2.5 billion in dividends. That leaves $9.5 billion that can be used to pay off debt, buy back shares, or make investments.

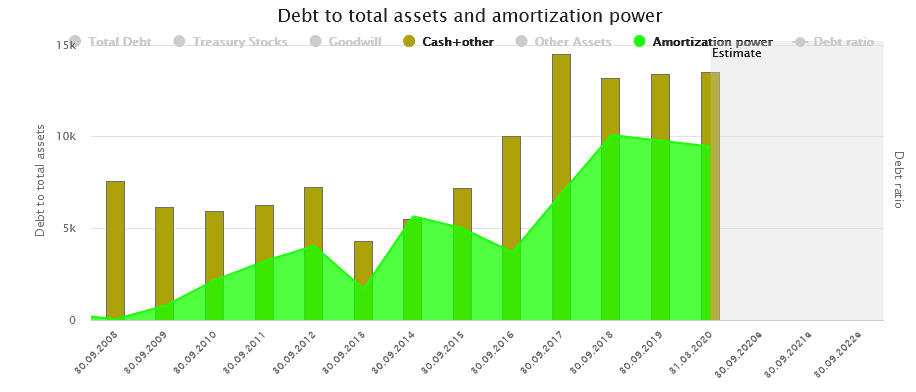

Much more important than the amount of the dividend is its security and the potential for future dividend increases. To this end, it is important that the company generates stable and rising profits. In addition, debt and the associated interest burden should not be too high. Visa currently has a debt ratio of about 50 percent. Considering that Visa could repay the debt in 4 years due to its strong cash flow, this figure is perfectly acceptable. Another key figure is the interest coverage. It indicates how often the company could cover its annual interest obligations from its operating profit. Here Visa achieves a coverage ratio of more than 33, so Visa has no problems to service the interest and would have more than enough room left even in case of a slump in profits. Irrespective of the current cash flows, the dividend is also more than adequately covered by the cash holdings. In the chart above you can see that the 2.5 billion USD in dividends are offset by 13.5 billion USD in cash. So Visa would have enough cash to fund the dividends for over 5 years purely out of its assets.

Having established that the dividend is safe, we are now looking at the potential for further increases. As mentioned, Visa could increase the payout ratio. This would increase the dividend significantly in one fell swoop. It would also mean that a larger portion of the profit growth would continue to flow into the dividend in the future. However, since Visa has been pursuing a constant payout policy for years, I consider this possibility unlikely. However, it is not necessary either, because Visa can use the surplus profits for other purposes which indirectly also promote dividend growth. For example, share buy-backs will increase future dividends, as the total amount distributed will then be spread over fewer shares. Another possibility is to repay debt. This reduces the interest burden and leaves more profit. The third option is to put the money into investments that ensure sales growth. This increases future earnings and the dividend can be increased.

In summary, the dividend of Visa is very secure and shareholders can expect strong increases in the future.

Wanna high dividend right from the start?

Then look at this 100 stocks with high dividens. If 100 is not enough, check out this list of 200+ high yield dividend stocks.

Is the stock of Visa cheaply valued?

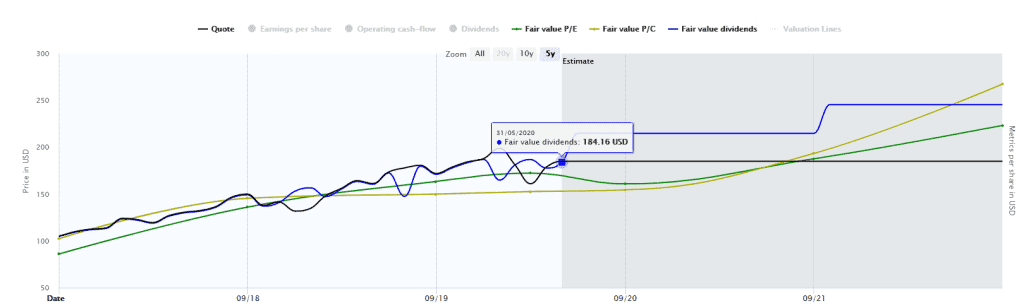

To find out whether the stock is attractively valued, we first look at the fair value based on historical multiples. If we start the forecast period in 2017, we get a result of USD 184 per share. This is slightly above the current price of USD 171. Based on profit and operating cash flow, we arrive at a fair value of between 155 and 160 for the current fiscal year. The stock would therefore be slightly overvalued. Whether Visa is fair or slightly overvalued depends on the historical multiple chosen. Thanks to a stable dividend policy, I would be guided by the dividend fair value.

If you let the observation period start in 2008, you will get lower multiples. However, I do not think that this comparison is meaningful, as Visa is much more profitable today than it was back then. So, I think you should use the last few years for the comparison.

I agree with the historical comparison and the market that Visa is fairly valued. In fact, I would go one step further and say that I find the stock attractive at the current price, because Visa is an extremely profitable company that will continue to generate stable earnings in the future through its business model. Visa’s revenue growth is particularly valuable because the high margins mean that much of the growth is also going into the pockets of us shareholders.

Conclusion: The Visa stock is a promising investment

Regardless of the valuation of the stock, it is clear to me that this is an extremely high-quality investment. Margins at this level are seen at few companies. In addition, the company has a stable business model that is not only profitable but also continues to scale despite its size, as it benefits from the increasing volume of global payment transactions. It is true that the dividend yield is currently low. In my opinion, investors are more than compensated for this by the security of the dividend and the expected dividend increases including price gains.

On the subject of valuation, I agree with the market. Although a P/E over 30 may seem high at first, you have to recognize that Visa is a higher quality company than many others. And quality is more expensive. I therefore consider the stock to be fairly valued. If you think the stock is overpriced, you can add the stock to your watchlist and get automatically alerted once your target price has reached.

1 Comment

[…] company is primarily active as a payment processor, integrating other payment providers (such as Visa or MasterCard) into its payment infrastructure. For a fee, Wirecard can organize the transactions […]