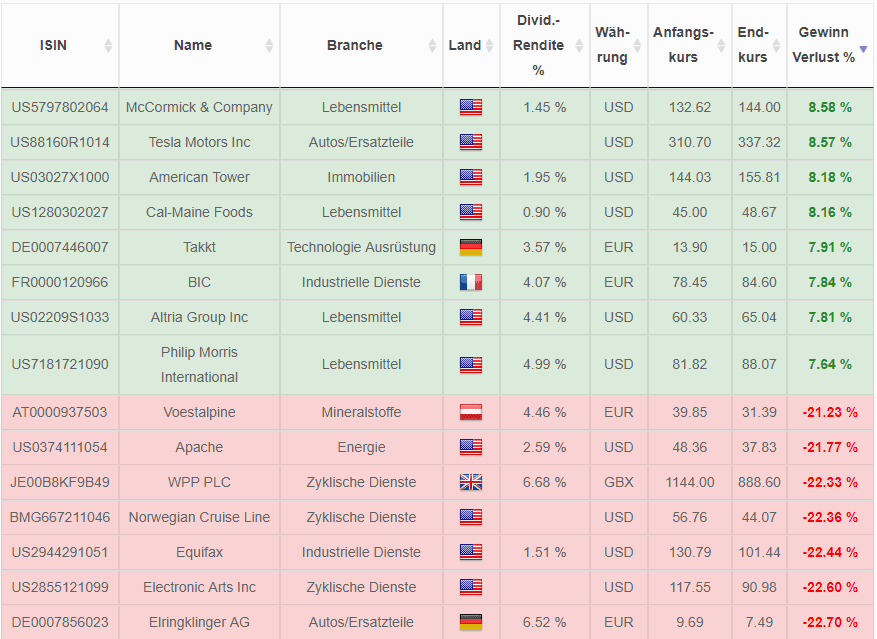

Winner and loser stocks November 2019

December 2, 2019

Dividend Stocks on Discount – January 2020. Fundamental Analysis – is not Rocket Science ?

January 10, 202020, 30, 50 or even 100% capital gains within 12 -months in 2019. The topleader in performance „Avon Products“ would have contributed 271% capital gains to your portfolio in 2019. But is such a top performer a good choice for a long-term investment? This question is primordial, because at least a part of your fortune is at stake.: If you´d have invested $1.000 USD in Tupperware in the beginning of 2019, you lost $730 USD. A little comfort: stock prices cannot tank below 0 USD– on the other hand sky is the limit when prices go up.

Let´s take a closer look at the three winner stocks coming from North America. We check whether these stocks are a promising buy for long-term investors. One thing I tell you in advance, which will probably surprise you: none of these companies shines with long-term profit growth. Let me explain why the stocks were nevertheless successful in 2019 and what I think of the stocks as an investment for your portfolio.

Winner and loser stocks in 2019

Here you see the the winner and looser stocks in 2019.: The winner stocks we take a deeper lock are Avon Products, Shopify and Advanced Micro Devices.

Winner stocks 2019

The winners of the month are not automatically a promising investment in the long term. Although the time horizon is much longer compared to a month, the same is true for the winners of the year. Avon Products is a good example that a good performing stock in one year may be a bad long-term investment.

Avon Products Stock – Game over soon

Avon Products is a cosmetics and lifestyle company. The stock price increased by 271 percent in 2019. However, at a price of $5.64, long-term investors still lost a huge amount of money. Since September 2008, the stock has tanked by 87 percent. In its darkest days, the stock lost almost 97 percent.

[stock_market_widget type=”chart” template=”basic” color=”blue” assets=”AVP” range=”10y” interval=”1d” axes=”true” cursor=”true” api=”yf” style=”height: 350px;”]

Low stability metrics in the table above are mirrored by the chart below – cancellation of dividends included:

Those who suspect Avon Products to be a turnaround candidate will be disappointed. The stock won’t trade for much longer, because a Brazilian company called Natura & Co will soon acquire Avon Products, which also explains its most recent capital gains. Game over soon.

Shopify Stock – Capital gains despite growing losses

The stock of Shopify gained 173 percent last year. The Canadian company specializes in online payment systems for small businesses on the internet and offers them an overall solution including marketing, shipping and distribution.

| Shopify Key Items | |

| Logo | |

| Country | Canada |

| Sector | IT-Services |

| ISIN | CA82509L1076 |

| Market Cap | $46,8 billion USD |

| Dividend-Yield | 0% |

| Stability of Dividends | – |

| Stability of Profits | -0,9 of max. 1.0 |

The IPO was in May 2015. The issue price of the stock was 17 USD. Today the stock is quoted just below 400 USD. Anyone who invested right from the start gained 2,239 percent consisting entirely of unrealized capital gains, because Shopify does not pay dividends.

[stock_market_widget type=”chart” template=”basic” color=”blue” assets=”SHOP.TO” range=”10y” interval=”1d” axes=”true” cursor=”true” api=”yf” style=”height: 350px;”]

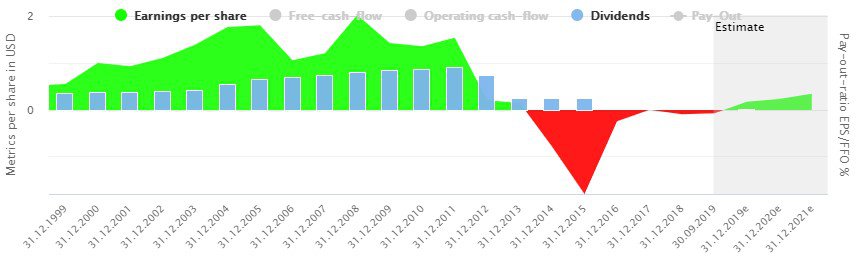

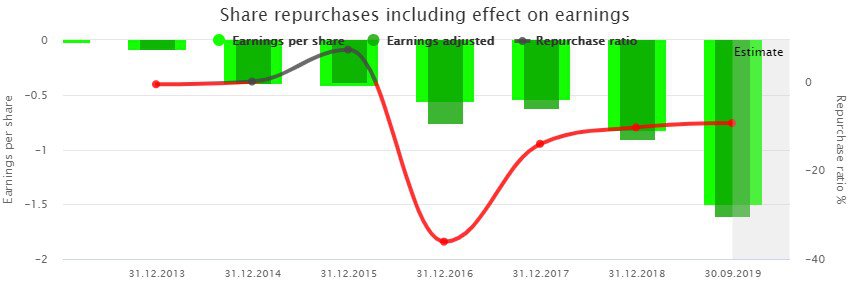

If you looked at the stability metrics for Shopify, you may have noticed that they look “even worse” than they do for Avon Products. And yet the stock price is rising. What’s going on there? The chart below shows that Shopify’s looses more and more money each year:

Somehow the stock market does not seem particularly worried about the increasing losses. On the contrary, the stock price goes up from year to year. So, should you short the stock right now before the public gets aware of the pending drama? Don’t! A glance at Shopify’s total sales points to a rapidly growing company far from crisis:

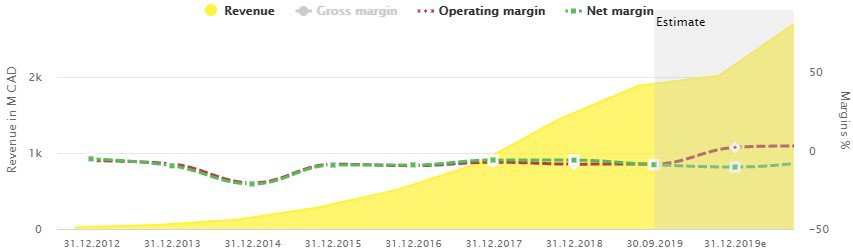

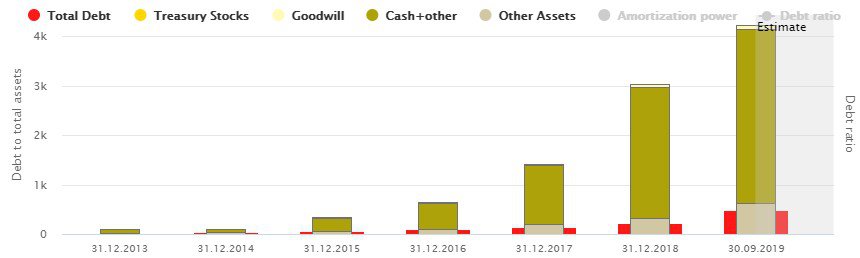

At the end of 2012, the company achieved sales of 23.5 million Canadian dollars. Within the last four quarters, this figure has grown to almost 1.9 billion. However, the operating margin is -8.5 percent. Hence the losses. But they seem to be factored in. Growth at the expense of profit. Can this work? To answer the question, let’s look at the most important balance sheet items:

Over $3.5 billion Canadian dollars in cash and short-term investments compare to less than $500 million CAD debt. This allows aggressive growth with negative margins for years to come. Now you may be scratching your head wondering how a company can make losses on the one hand but accumulate more money every year on the other – without increasing its debt. The answer is found in this chart, which shows you the change in outstanding shares, among other things:

With shareholders being excited about Shopify’s growth story, the company can place new shares on the market, bringing fresh capital to the balance sheet to continue funding aggressive growth, including acquisitions.

The example of Shopify shows that even a very meaningful metric such as profit stability cannot adequately describe a company in isolation. If you filter our stock screener according to profit stability, you may miss a potentially promising stock like Shopify. This may be unpleasant, but I think it’s justifiable because a lot of really unpromising “investment opportunities” are rejected, too., while a lot of promising opportunities remain.

AMD stock – up and down over and over again?

From 31 USD to 5 USD to 42 USD to 2 USD to 10 USD to 2 USD to currently 46 USD. Welcome to the stock of AMD, the permanent number two in classic processors behind Intel. Besides processors, AMD also sells graphics cards, which was made possible by the successful acquisition of the Canadian graphics card manufacturer ATI in 2006.

| AMD Key Items | |

| Logo | |

| Country | USA |

| Sector | Semiconductors |

| ISIN | US0079031078 |

| Market Cap | $54,1 billion USD |

| Dividend-Yield | 0% |

| Stability of Dividends | – |

| Stability of Profits | 0,3 von max. 1.0 |

Less successful, however, was the operation of proprietary factories in Austin near Texas and Dresden, Germany. When things went bad again, AMD was forced to sell the factories through a spin-off called GlobalFoundries and has been “fabless” ever since.

[stock_market_widget type=”chart” template=”basic” color=”blue” assets=”AMD” range=”10y” interval=”1d” axes=”true” cursor=”true” api=”yf” style=”height: 350px;”]

But thanks to a strong product pipeline, things are currently running smoothly again. The head of AMD, Lisa Su, sums it up in the press release of the latest quarter:

“Our first full quarter of 7nm Ryzen, Radeon and EPYC processor sales drove our highest quarterly revenue since 2005, our highest quarterly gross margin since 2012 and a significant increase in net income year-over-year.”

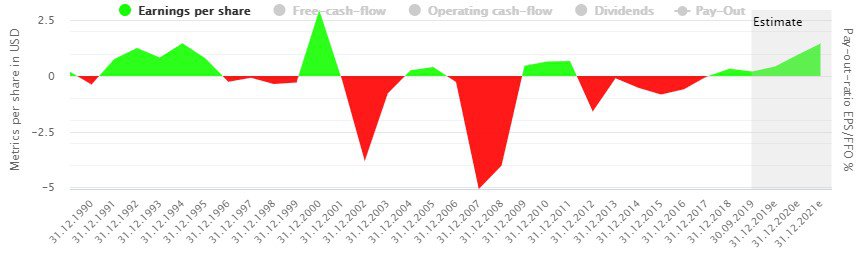

Still, I have a déjà vu and I don’t see AMD as a conservative investment for buy-and-hold investors. AMD’s long-term profit growth illustrates what I mean when I write about “up and down over and over again”.

Conclusion: Buy “long-term profit growth” instead of “capital gains”

Well-performing stocks automatically attract the interest of investors. AMD, too, was increasingly in demand by the community of DividendStocks.Cash when the stock price rocketed and was finally added to the list of analyzed stocks on Dividendstocks.Cash. However, such “fashion stocks” are a much riskier investment compared to companies with stable profit growth. In 2019, which was a very rewarding year on the stock market, even conservative, high quality stocks yielded substantial returns. Dividendstocks.Cash contains a total of 223 companies with a profit stability of at least 0.9 of max. 1.0. With these stocks, an average return of 28.2 percent was achieved in 2019, fairly relaxed and without taking dividends into account. 28.2 percent is slightly above the also very well-performing MSCI World of 24.9 percent (performance is calculated in the local currency of the stocks).

If you look for stocks with long-term profit growth to benefit from growing dividends and capital gains, just register as member. Basic membership is free of charge.

Excellent tool for investors looking for quality stocks in a fast and easy manner – TRADERS’. Magazine for traders and investors