Procter & Gamble stock – A giant with rising dividends and 100 percent stock price gains

August 21, 2020

Deutsche Börse Stock – more profitable than Nasdaq and LSE

August 29, 2020The Bayer stock has been very frequently featured in the media in recent years. In particular, the gigantic takeover of the “dreaded” crop protection manufacturer Monsanto and the wave of lawsuits against the chemical active ingredient “glyphosate” that unleashed after the takeover were a real nourishment for politicians and the media. There was no shortage of criticism. However, Bayer is still a publicly traded company that is making a profit year after year. Is it possible to achieve an attractive return on Bayer stock despite – or perhaps precisely because of – the negative media coverage? You’ll find the answer in this stock analysis, where I also look at the Monsanto acquisition and its impact on Bayer’s business model.

| Bayer stock | |

| Logo |  |

| Country | Germany |

| Industry | Agriculture&Pharma |

| Isin | DE000BAY0017 |

| Market cap. | 67,6 billion $ |

| Dividend yield | 5.0% |

| Dividend stability | 0.93 of max. 1.0 |

| Cash-Flow stability | 0.76 of max. 1.0 |

With nearly 104,000 employees in 87 countries, Bayer is no longer a traditional pharmaceutical company but a life science enterprise with core competencies in health care and – since the acquisition of Monsanto – agriculture. Bayer’s vision is “Health for all, Hunger for none”. This is a vision that is as ambitious as it is noble. In the health sector, it is about improving the quality of life by preventing, easing and curing diseases. In agriculture, the focus is on the reliable supply of high-quality food and animal feed. However, Bayer’s work also meets with public criticism, which I will address later, in the course of the takeover of Monsanto. First, I want to introduce Bayer’s business model in more detail.

The business model: How Bayer makes money

Bayer’s business model is based on segments that together generate over 99 percent of all revenues worldwide.

Crop Science

This segment comprises Seeds, Crop Protection and Insect Control. In addition to the physical products of seeds and crop protection solutions, various services are offered, for example to monitor insect control more efficiently.

Bayer has a leading seed product portfolio for corn, soybeans, cereals and fruit and vegetable crops and is the largest integrated company in the agricultural industry. Integrated means that Bayer not only develops and manufactures high-yielding seeds, but also crop protection products that are ideally matched to the seeds to ensure the highest possible yield in agriculture. In the long term, according to management, Bayer is focusing on innovation, digitization and sustainability. At Crop Science, the focus in 2020 will be on the further integration of Monsanto. The acquisition has cost Bayer USD 66 billion, and that is only part of the cost. After all, a takeover is far from complete when the purchase agreement is signed. The difficult part only begins afterwards. Synergies must be worked out and implemented in order to achieve the hoped-for savings and sales increases. The different procedures, processes and corporate cultures must also be analysed and adapted. These aspects are a great effort for change management. Even a non-expert can imagine that a giant like Monsanto, with its workforce of nearly 21,000 employees before the takeover, is not easy to integrate into Bayer.

Pharmaceuticals

The Pharmaceuticals segment focuses on prescription products. The main areas are cardiovascular and women’s health. The company also offers specialty therapeutics in oncology (cancer), hematology (blood disorders) and eye-related areas. In addition to prescription products, this segment also includes radiology, where medical devices for diagnostic imaging are developed and manufactured. The increasing aging of the population is leading to an increase in chronic diseases, which will have a positive impact on sales from an economic perspective.

In the short to medium term, growth in the Pharmaceuticals division will be based on China and important drugs such as Xarelto. Xarelto is Bayer’s top-selling drug, with sales of almost EUR 4 billion, and is used to prevent blood clotting. In addition to this blockbuster drug, Bayer has other drugs in the development pipeline. At this point I would like to talk about the development and approval of drugs, because in my opinion this is one of the biggest risks facing Bayer. (You can read a detailed explanation here)

Excursus: The approval of drugs

As soon as an active ingredient leaves the research department, the approval process begins. The first step is to test for effect and tolerability. In these tests, animal experiments are used – also due to legal requirements – to screen out possible toxic or otherwise harmful active ingredients. The next steps are divided into three phases of clinical testing. In phase I, a limited number of volunteers are used to analyse how the active substance travels through the body, how long it takes and at which dose side effects occur. Phase II is carried out on 100 to 500 adult patients. Efficacy, tolerability and dosage will be investigated. In phase III, doctors in several countries are testing on several thousand patients. The aim is to detect even less frequent side effects. It will take about 13 years until the final drug reaches the market! During these 13 years, the company does not earn a cent with the new active ingredient. Instead, they have to pay researchers’ salaries, equip research laboratories and spend money on clinical trials. And in spite of the high expenditure, there is no guarantee that the drug will be approved. Even in the case of approval, it is uncertain whether the drug will generate enough revenue to recoup the costs, for example because a competitor’s drug has the same or even better efficacy. To spread the risk, Bayer also relies on external innovation through research collaborations and individual licensing.

In return for the risk taken, the active ingredients can be patented for a period of 20 years. Once this patent expires, any company can manufacture a similar product (often referred to as a generic) and the market share gained with the once-new drug can collapse dramatically.

Consumer Health

The Consumer Health segment mainly comprises over-the-counter (OTC) products. These medicines are offered in the categories dermatology (skin diseases), nutritional supplements, pain, gastrointestinal diseases, allergies and colds. There are also some brands that you may be familiar with in this area. The best examples are Aspirin for headaches, Canesten for skin and foot fungus or Bepanthen as a wound and healing cream.

Bayer takes over Monsanto – Why?

The agricultural industry is facing major challenges. On the one hand, the world population will continue to grow steadily over the next few decades. On the other hand, climate change and global warming make it more difficult to grow food. According to Bayer, Monsanto provides the know-how to master this unfavorable constellation.

In addition to its know-how in biotechnology, Monsanto plays a leading role in the field of “digital farming”, which deals with the development of digital solutions in agriculture. For example, farmers – if equipped accordingly – can use an app to view the insect development in their fields and, if necessary, react with a proposed crop protection product. Before the acquisition, Monsanto was one of the world’s largest producers of seeds, often genetically modified, and weed control products. The company had sales of almost USD 15 billion and made a profit of USD 2.3 billion. The partially bad reputation of Monsanto has been caused by questionable activities e.g. towards farmers in South America and Asia. In addition, Monsanto has genetically modified seeds so that farmers cannot reuse crops such as corn or soybeans as seeds, which is perceived by many as ethically wrong.

From an antitrust point of view, the takeover of Monsanto is also controversial because Bayer became the world’s largest seed producer at a stroke. As a result, Bayer had to sell some business shares in the agricultural solutions business. The buyer was another German industrial giant – BASF.

The glyphosate lawsuit

By acquiring Monsanto, Bayer more or less consciously took significant risks. Not only because of the high purchase price of US$ 66 billion and Monsanto’s poor reputation, but also because of the acquisition of certain products. One example is the crop protection product “Roundup” containing the active ingredient “glyphosate“. In the United States in particular, plaintiffs accuse the company of having failed to warn the public about the dangers of the product and of being carcinogenic. In the case of Dewayne Johnson, a cancer sufferer, the US court approved a claim for damages of 289 million dollars. With almost 125,000 other similar lawsuits, this represents a gigantic financial risk. Bayer’s image also suffers from these accusations, and confidence in the brand is declining. However, the verdict was reduced to $20.5 million at the end of June. Bayer says it is a step in the right direction, but remains of the opinion that the verdict is not consistent with the evidence and applicable law.

A further partial success for Bayer is the settlement reached with more than 100,000 plaintiffs in the United States, also at the end of June. Bayer is paying USD 10.9 billion for this settlement. At a stroke, three-quarters of all lawsuits are thus off the table. Nevertheless, the company does not see this as an admission of guilt or misconduct. Payment of the compensation will begin this year. This had a direct impact on profits in the second quarter of 2020, as you will see in the next section.

Despite initial successes in the legal battle, I still see a high financial risk, as thousands of lawsuits are still pending and further lawsuits against other herbicide are already being prepared.

Is Bayer’s business model profitable?

Bayer’s new business model is quite promising despite strong headwinds. But is the potential of the transformation from a pharmaceutical company to an integrated pharmaceutical and agricultural company already reflected positively in the key figures?

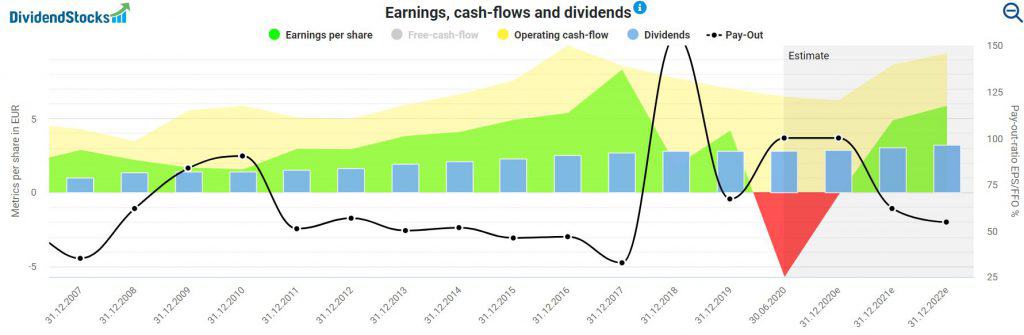

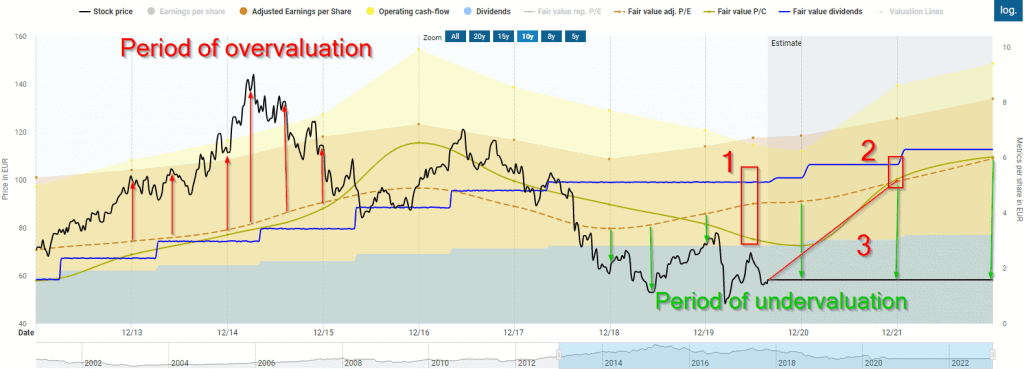

At first glance, unfortunately not. But you shouldn’t write down the Bayer stock too quickly. The Chart on Dividendstocks.cash already shows positive developments that remain hidden from other financial pages. But let’s start at the beginning. Profit, cash flow and dividend have been rising steadily for a long time, starting in 2010, from bottom left to top right. This was followed by the acquisition of Monsanto in 2018. Some of the business had to be divested and the $66 billion was paid for the purchase. The impact is visible from the collapse in profits and the declining operating cash flow in 2018. Since then, things have continued to decline with the above-mentioned key figures. This is a strong indicator that the integration of Monsanto has not yet been able to generate the hoped-for synergies and additional revenues. The loss in the first half of 2020 can be attributed in particular to EUR 12 billion spent on the settlement of the glyphosate litigation. If we adjust earnings by this factor, Bayer achieved earnings per share of EUR 1.53. This would mean a full-year profit of just over EUR 3 per share and would thus be only a slight decrease compared to 2019 despite the corona crisis.

The Chart on Dividendstock.cash visualizes massive differences between the reported and adjusted earnings:

However, based on the forecasts, an increase can be seen, especially in the operating cash flow and profit for the years 2021 and 2022. The analysts continue to assume that the takeover will ultimately be successful. We will only see whether this proves true in the next few years. However, I am confident that the global megatrends are playing into Bayer’s hands because the company has aligned itself accordingly.

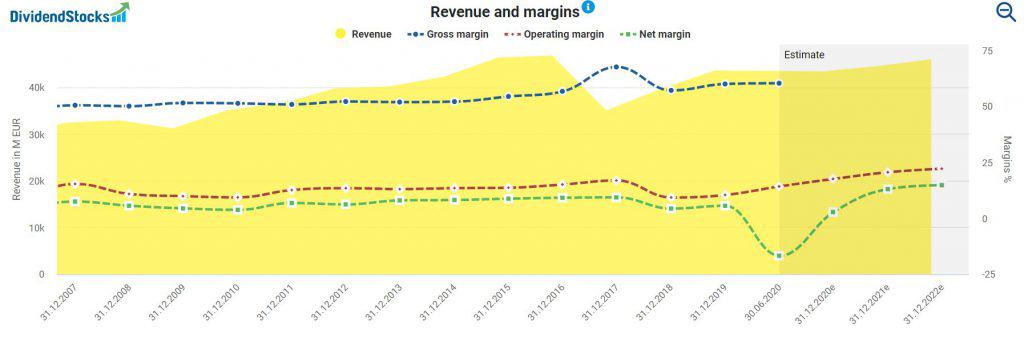

How are sales and margins developing?

Margins are very constant. The years 2018 and 2019 are an exception, again due to the special influences of the Monsanto acquisition. In terms of margins, you can also very well see the impact of the payment regarding the settlement in the glyphosate litigation. In the second quarter of 2020 the net margin collapsed significantly. But the operating margin actually increased slightly. This shows that Bayer has a solid business model operationally and is earning well from it. However, the expense of the settlement is “just” a one-time negative effect. Despite the corona crisis, sales declined only slightly and are forecast to rise further in the coming years.

Is the Bayer dividend secure?

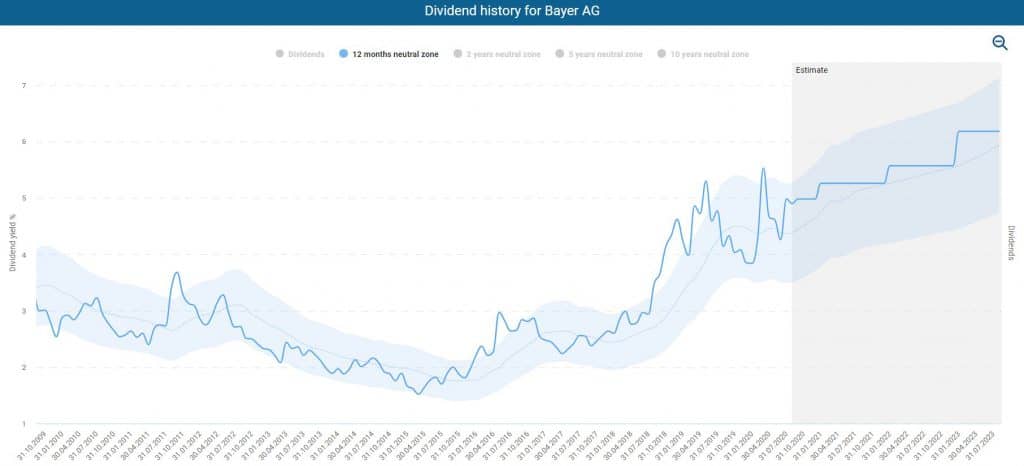

Established pharmaceutical companies often pay out a significant proportion of their profits and are therefore justifiably popular among dividend fans. The Bayer stock currently attracts investors with a historically high dividend yield of 4.9%.

In the dividend turbo you can see that the current dividend is close to the upper end of the 12-month corridor. In fact, the current dividend yield is exceptionally high by historical standards. However, the high dividend yield is primarily due to the stock price, which has been falling for some time and not to the continuous increase of the dividend.

In addition to the high dividend yield, I would like to focus in particular on dividend security, because Bayer is currently paying a dividend that is temptingly high for many stockholders.

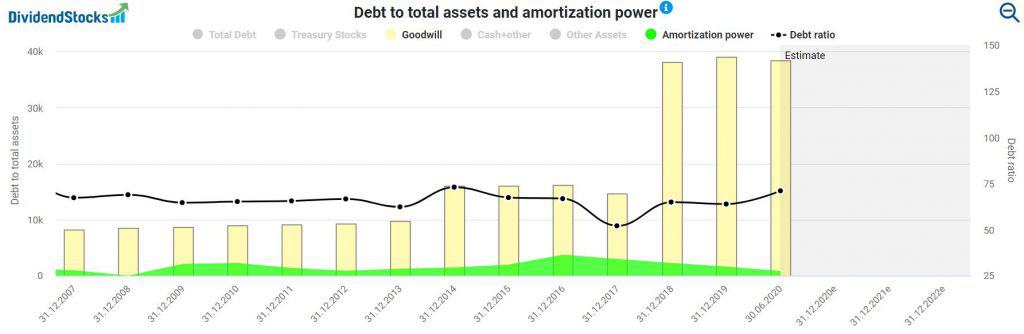

Let me start with the debt ratio. The long-term average debt ratio is between 60 and 70 percent. At 71 percent, the debt ratio is slightly higher, but in view of the financial burden associated with the huge takeover of Monsanto, it is within reasonable limits. Bayer’s management decided not to increase the dividend further in the last two years. In my view, this was the right decision because Bayer is exposed to exceptional financial burdens due to the integration of Monsanto and various legal disputes. The extent of the financial burden is evident from the fact that the ability to repay the dividend has been diminishing since 2017. If this trend continues, a dividend decrease is possible as early as next year. Whether or not this will occur will depend to a large extent on the course of open and future legal disputes.

In the chart above, I would also like to mention the explosive development of goodwill. Goodwill arises on the purchase of another company if the purchase price exceeds the net asset value of the company purchased. The net asset value is the amount of money that, according to the balance sheet, would have to be spent to rebuild the company. Goodwill can be justified if the acquired company can show, for example, patents, trademarks, know-how or a large customer base. These often intangible assets are usually only incompletely recorded in the balance sheet, but are nevertheless valuable.

The danger of high goodwill lies in depreciation. This is because a so-called impairment test must be carried out annually to determine whether the goodwill is still fully recoverable. If not, a depreciation must be carried out. A depreciation is de facto nothing else than the admission of the management that the purchase price was too high at the time of the takeover. In addition, a depreciation pushes down profits, which usually has a negative impact on the stock price. However, there is no cash flowing in the case of depreciation, because it was already flowing during the takeover. Nevertheless, a depreciation reduces equity and can thus lead to a considerable change in important key figures such as the equity ratio (equity/total assets) or the debt ratio (debt/equity). According to Bayer management, the Monsanto acquisition was worth EUR 18.9 billion in goodwill.

Is the Bayer stock fairly valued?

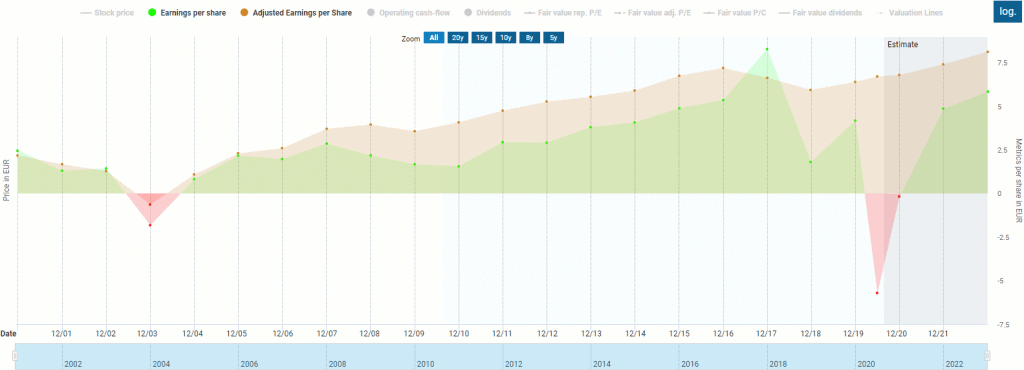

To find out whether the Bayer stock is a bargain after the price losses of recent years, I use DividendStocks.cash´s Dynamic Stock Valuation. Since earnings fluctuates considerably due to the sale of businesses, special items and litigation-related expenses, I refer to the adjusted earnings plus operating cash flow and the dividend to determine the fair value rather than the reported earnings.

The fair value based on the operating cash flow is currently EUR 78, for the adjusted earnings EUR 94 and for the fair value dividend EUR 99 (see 1.) In contrast, the current stock price is only EUR 56. Due to further possible payments in the lawsuit and a burden from the Corona crisis, analysts expect an overall weak fiscal year 2020, but the worst is expected to be over in fiscal year 2021. As a result, adjusted earnings, dividends and, above all, operating cash flow are expected to rise significantly and the fair values would be very close to EUR 104 (see 2). According to this positive scenario, Bayer´s stock is significantly undervalued and, if bought, would have a upside potential, including dividends, of 92 percent by the end of 2021 (see 3).

Alternative investments

If you are looking for more dividend stocks in Chemicals sector, the following stock analysis might also be interesting for you.

| Name | Isin | Country | Industry | Analysis |

| BASF | DE000BASF111 | Germany | Chemicals |  |

Conclusion: Bayer stock as a turnaround candidate

Bayer’s management fundamentally restructured the company’s business model, which initially made the Bayer stock a disappointing and risky investment. Even though the headwind created by the Monsanto acquisition is stronger than management probably imagined, the realignment of the company makes sense in my view. And despite the billions in charges resulting from the Monsanto acquisition and the litigations, Bayer’s balance sheet remains healthy and its operating business intact. In addition, analysts estimate that Bayer could be out of the woods in 2021. If that’s true and Bayer can focus on day-to-day operations, I expect high returns.