The Fresenius stock – An underrated dividend aristocrat?

January 18, 2021

Stryker Stock – a healthy investment?

February 14, 2021The Altria stock was a darling of shareholders for a long time. A stable and high cash flow ensured increasing dividends year after year also driven by share buybacks. On top of that, there were decent stock price gains. The stock seemed to be a no-brainer. But that is history now. Altria’s stock price has plummeted by more than 46 percent since its peak in 2017. While the broad stock market has rushed from record to record in recent years, Altria shareholders have been left in the dust. The stock is worth no more today than it was in 2013.

On the other hand, the tobacco company offers an exceptionally high dividend yield of over 8 percent and a very favorable valuation at first glance. This stock analysis will tell you whether buying Altria offers you a unique opportunity for decent returns or whether you will burn your fingers.

The business model: How Altria makes money

Altria, along with Philip Morris, British American Tobacco, Imperial Brands, and Japan Tobacco, is one of the world’s four major publicly traded tobacco companies and is best known for its Marlboro brand. Altria originally traded under the name Philip Morris. In 2008, management decided to spin off the international cigarette business as a separate company due to the threat of class-action lawsuits against tobacco companies. Since then, Philip Morris has traded on the stock market as a stand-alone company, while Altria operates only on the U.S. market.

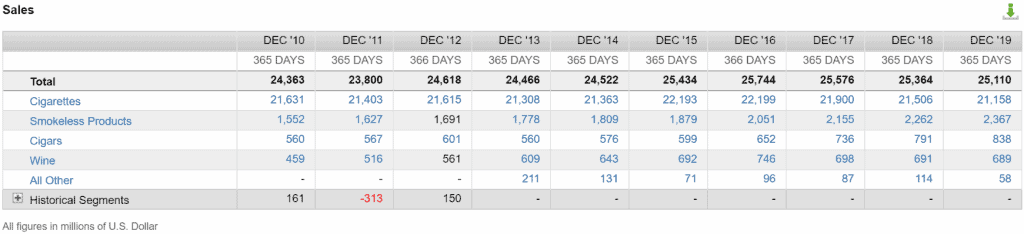

Altria divides its business into three segments: “Cigarettes (Smokeable products) including Cigars,” “Smokeless products,” and “Wine.” Besides, Altria holds major corporate investments, which we also discuss in this analysis.

Cigarettes (Smokeable products)

The largest segment by far is “Cigarettes.” The most recently completed fiscal year 2019 accounted for USD 21.2 billion of the total USD 25 billion in revenues, representing nearly 85 percent of its revenue. The segment includes tobacco products such as cigarettes, pipe tobacco, and cigars. In the USA, Altria is the cigarette company with the highest sales. For more than 45 years, Marlboro has been one of the most important cigarette brands with a market share of more than 40 percent. In cigars, Altria is known for its Black & Mild brand, which the company sells through its subsidiary John Middleton.Cigarettes.

Smokeless Products

The second-largest segment, Smokeless products, contributed a total of USD 2.4 billion to the company’s earnings in fiscal 2019, representing 9.4 percent of total revenues. In this segment, Altria sells tobacco products that are not burned during consumption and are therefore smokeless and generally healthier at the same time. Examples are oral tobacco under the Copenhagen or Skoal brands. Also, Altria has been granted the exclusive right by Philip Morris International to market so-called “heated tobacco products” under the IQOS brand in the USA. Here, the tobacco is not burned but merely heated. Unlike e-cigarettes, IQOS uses real tobacco, whereas e-cigarettes use liquids that are heated and contain flavors and possibly nicotine. Altria abandoned the e-cigarette market in 2018 and ceased production and distribution of all e-products. Instead, Altria acquired a stake in Juul, the U.S. market leader for e-cigarettes (see below).

Wine

Altria also sells table and sparkling wines (as well as champagne and crémant) through its subsidiary Ste. Michelle. The best-known brands are “Chateau Ste. Michelle” and “14 Hands. The Wine segment is relatively small, contributing just under 3 percent of total sales at USD 689 million. Because of restaurant and event closures, this segment has been hit so hard by the Corona pandemic that USD 292 million worth of inventory had to be written off in fiscal 2020. On the other hand, the Corona pandemic did not harm the different two segments, as sales in supermarkets, etc., were also possible during the lockdown.

Other assets

Altria continues to hold notable corporate investments. For example, Altria owns 10.1 percent of Belgian beer giant AB InBev. In addition, Altria management acquired a 35 percent stake in e-cigarette maker and market leader Juul in 2018 for USD 13 billion, and in the same year bought a 45 percent stake in Canadian cannabis producer Cronos for USD 1.8 billion, with the option to acquire an additional 10 percent stake for a price of USD 19 per Cronos stock.

Altria management under pressure

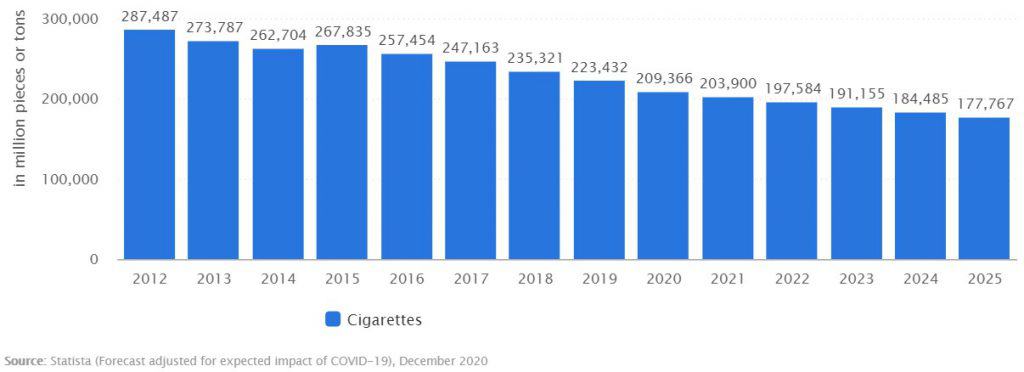

For a long time, Altria was considered a safe investment with a straightforward narrative: people will always smoke – thanks, among other things, to well-known brands such as Marlboro. Today, cigarettes are generally regarded as a dying product, and glowing sticks are unhealthy and unfashionable. Accordingly, consumers turn away from cigarettes and search for alternatives such as e-cigarettes or marijuana. For decades, the volume of cigarettes sold in the U.S. has been declining. At the same time, Altria’s core business is regionally limited to the U.S. market, where this trend is particularly pronounced:

Cigarette volumes in the USA have been falling for years – a development that is likely to continue, source: Statista

At the same time, Altria’s management struggles to adapt its products to changing consumer needs by pushing so-called next-gen products. The company’s profits are still largely dependent on sales of the classic cigarette. And in its attempt to diversify the business by acquiring stakes in Juul and Cronos, management recently did a very poor job. The purchase price for Juul, for example, seemed overpriced in the eyes of many shareholders even at the time of the takeover. Less than three years after the acquisition in 2018, a total of USD 11.2 billion has been written off. A billion-dollar grave! Juul’s challenges are many: the company struggles with legal issues and sales bans as it seeks to target younger people. As a result, CEO Kevin Burns had to leave. Also, Juul had to lay off around ten percent of its workforce in 2019.

Altria’s attempts to walk into the marijuana business are also not paying off so far. In the U.S., the company is still waiting for cannabis consumption to be legalized at the federal level. Further, the market is highly fragmented, and it remains to be seen if Cronos can beat the competition with Altria behind it. While Cronos has significantly increased revenue to USD 23.8 million (2017: USD 3.1 million), the cannabis manufacturer is still far from profitability, with an operating loss of USD 119 million. As a result, Altria management paid far too high a price for Cronos at USD 1.8 billion, similar to Juul. Last year, for example, the Cronos stock was listed at times at less than CAD 7. Although it has since climbed back above CAD 13, it is still a long way from the CAD 19 for which Altria has the right to acquire a further 10 percent of Cronos stocks.

The AB InBev stake is indeed an asset independent of tobacco consumption, which provides some diversification. However, there are holes in the safety net. The beer company from Leuven (Belgium) is struggling with massive debt and falling sales due to a global slowdown in beer consumption, including short- and medium-term losses from the Corona pandemic. Dividends were cut, and management conceded the outlook for the current fiscal year 2021 due to the high level of uncertainty. Overall In fiscal 2019, the investment in Ab InBev contributed USD 1.725 billion to earnings, while the write-offs on Juul cost USD 8.6 billion, and the write-offs on Cronos was USD 1.4 billion.

Is there still room for further growth?

Altria’s management is trying to compensate for the declining cigarette volumes by cutting costs and raising prices. However, with moderate success, because sales in the “Smokeable products” segment have been falling continuously since 2017.

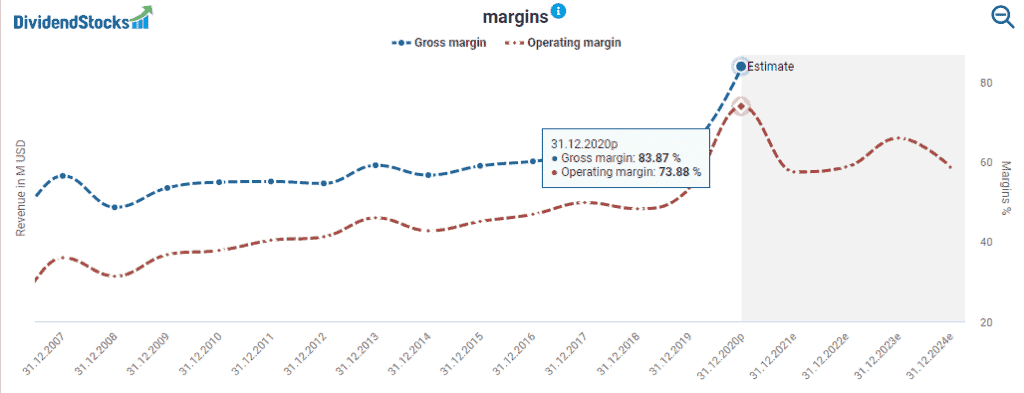

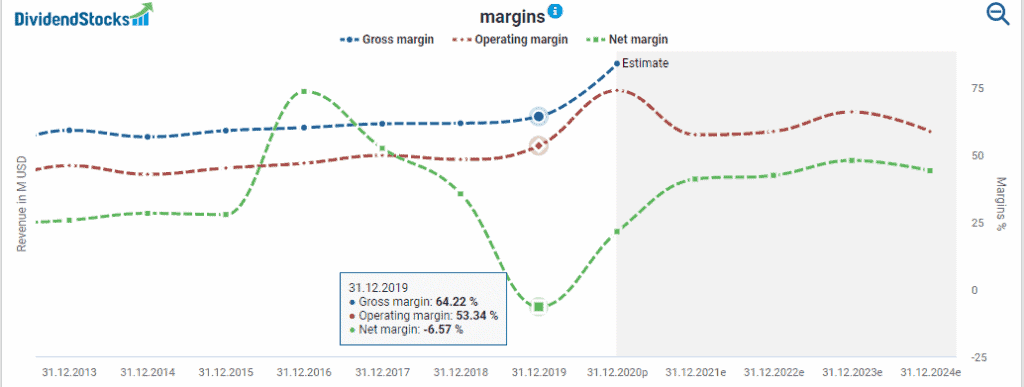

The decline in revenues over the last three years is problematic because Altria cannot continue to raise cigarette prices to the extent necessary to compensate for volume losses. Profitability, on the other hand, looks somewhat better. Cost savings, price increases, and (surprisingly) lower tobacco taxes have driven gross margin and operating margin steadily higher since 2015. Beyond that, however, the recent margin jump seems to be a flash in the pan.

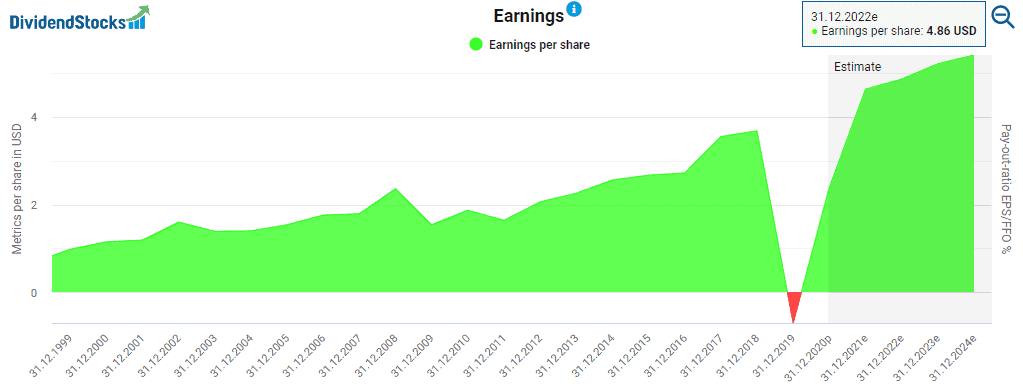

In theory, the increased margins ensure higher profits. However, despite higher operating margins, the company had to report its first loss in decades in fiscal 2019 due to write-offs on Juul and Cronos. As a result, earnings fell from USD 3.68 per Altria stock in 2018 to minus USD 0.70 per share in 2019. For fiscal 2020, reported earnings are also still well below 2018 levels at USD 2.39 but are then expected to pick up to USD 4.63 per share in the following year, which would represent a record profit.

The write-offs on JUUL are extraordinary charges because they have nothing to do with the operating performance. In our stock screener, the negative net margin for fiscal 2019 indicates a loss, although the operating margin has increased.

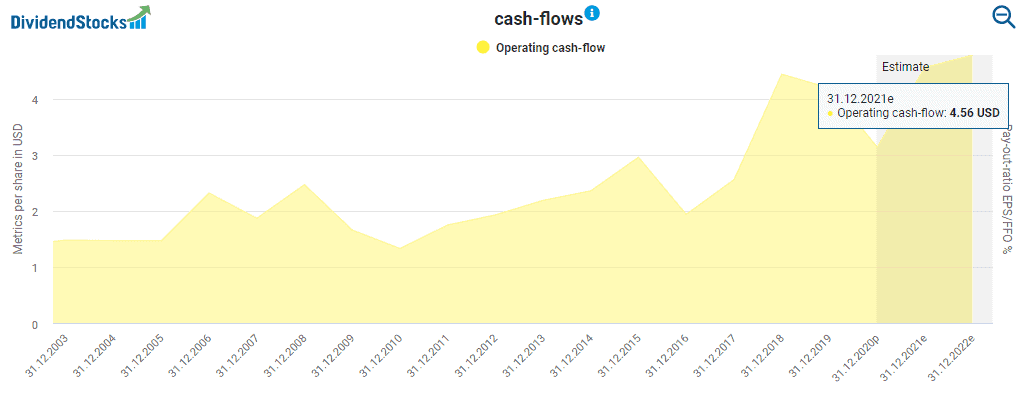

There is more light when it comes to operating cash flow, which is not affected by non-cash write-offs. Despite the setbacks, Altria is still a cash cow. While operating cash flow for 2020 is down from previous years at USD 3.14, it is likely to rise to a record level of USD 4.56 in the current fiscal year.

How safe is the Altria dividend?

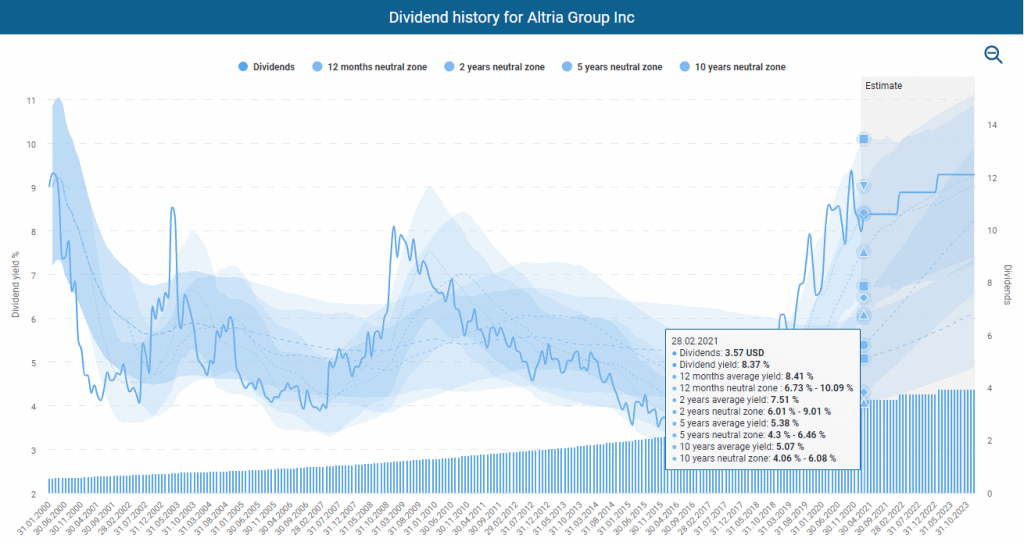

Altria pays quarterly dividends and has increased them every year for the past 51 years. The quarterly dividend rose from USD 0.14 in 1990 to USD 0.86 now. After the latest increase from USD 0.84 to USD 0.86, shareholders will receive USD 3.44 per share per year, which corresponds to a dividend yield of a whopping 8.17 percent at the current stock price of around USD 42. Over the past 10 years, Altria has increased its dividend by a respectable 9 percent on an annual average. Nevertheless, you should note that Altria benefited from tax reform in the U.S. in 2018 where it had increased its dividend twice, by 6.1 percent and 14.3 percent, respectively. The last and only increase in 2020 was much lower at 2.4 percent.

With a payout ratio of almost 80 percent, the leeway for further dividend increases is limited as measured by free cash flow. Analysts expect the annual dividend to increase to USD 3.56 per share in 2021, which corresponds to a modest 3.4 percent increase. That’s below historical averages but, given the already high payout ratio with an uncertain outlook, reasonable in my view. The times of higher dividend increases are, therefore, likely to be over for the time being.

Due to the stock price losses of recent months and years, the dividend yield is close to its historical high and well above the long-term corridor of the last ten years, according to the Dividend Turbo tool. The high dividend yield indicates an attractive entry point. However, given the stagnating core business, it is questionable whether you can expect Altria’s dividends to continue to rise in the coming years.

Is Altria fairly valued?

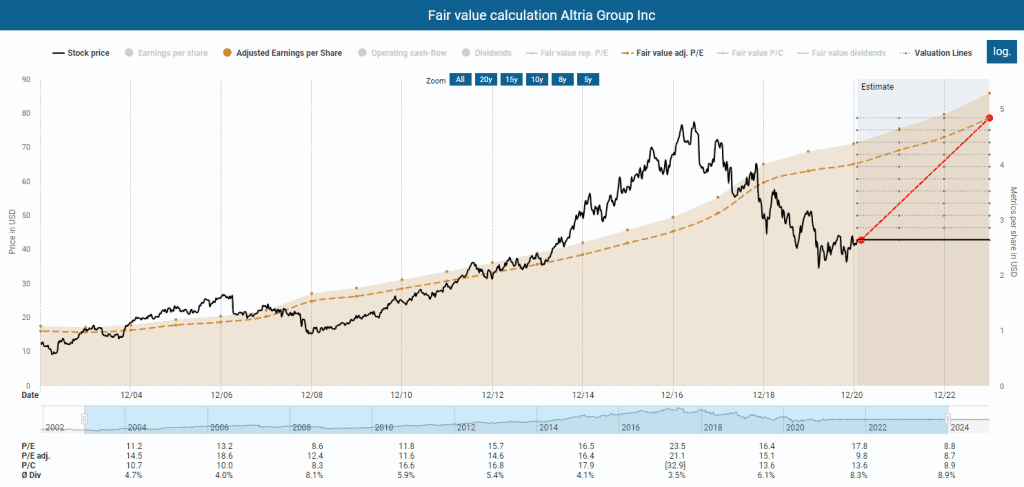

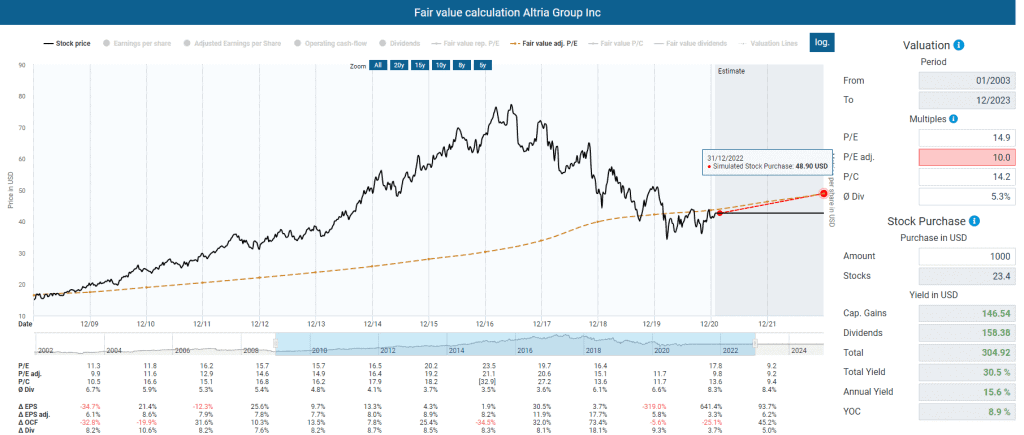

The Dynamic Stock Valuation shows that the operational problems and stock price losses of recent months and years have turned Altria stock into a fundamental bargain. Based on adjusted earnings in purely arithmetical terms, the upside potential to the end of 2022 is nearly 90 percent. A similarly high expected return emerges if we look at the projections of operating cash flow. The stock has a 73 percent upside potential with respect to its fair value. The Dynamic Stock Valuation also shows the Altria stock’s massive overvaluation, which peaked at just under USD 80 in mid-2017 and then turned into the opposite.

In my view, however, the drop in Altria’s stock price was not without reason. Because despite positive forecasts for the next few years, the core business’s long-term future is unclear. The company’s e-cigarettes have been discontinued, and the expensive investments have disappointed within a short time. As a result, dividend growth will soon reach its limit. To determine the fair value, I would adjust the multiples calculated in the Dynamic Stock Valuation downward, which can be easily done with the tool by manually overwriting the historical multiples.

Instead of the historical average P/E ratio of 15, I apply a P/E ratio of only 10. The lower P/E ratio considers the slower growth of earnings in the future, which should be somewhat in the mid-single digits. This results in significantly lower fair values. For fiscal 2022, the fair value, in this case, falls to just under USD 49, which would still correspond to an annual return of 15 percent until then, half of which would consist of dividends and price gains.

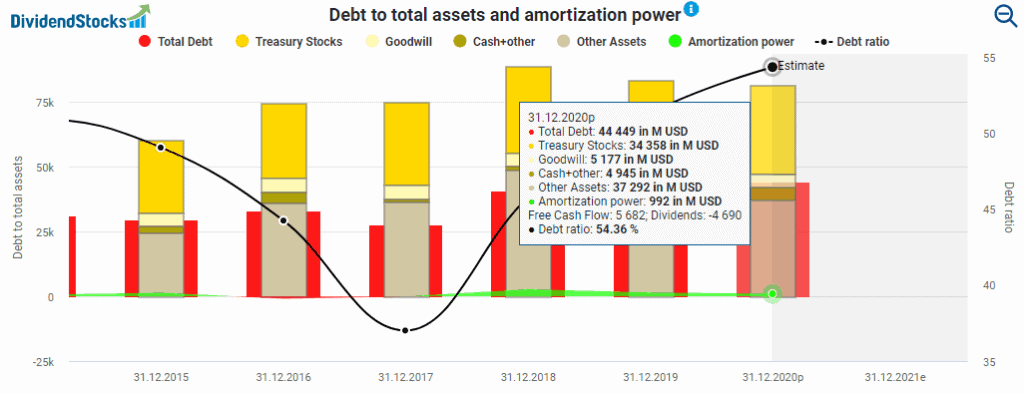

In addition, Altria carries billions in debt. The debt (plus all other liabilities) of USD 44.4 billion is barely offset by an amortization power of just under USD 1 billion. Bright spots are the mountains of treasury stocks worth USD 34 billion accumulated through share buybacks. Altria could use that money for acquisitions. Furthermore, the stable cash flow should ensure that the amortization power remains positive in the coming fiscal years, even considering expenses for dividends.

Conclusion Altria stock: With high dividends into an uncertain future

The shift away from traditional cigarettes is already accelerated. It seems that the Altria management has missed to cope with this and worsened the situation by rushing into acquisitions. Whether and when the costly acquisitions in e-cigarettes and cannabis will pay off is more than uncertain. What is clear is that shareholders have had to pay for management’s blunders. Although I have Altria stocks in my portfolio, I don’t see any reason to repurchase despite the supposedly low price with a high dividend yield. On the other hand, should management suddenly get a grip around these problems, the current price would prove to be a true bargain. Once again, exceptionally high dividends come at a price.

2 Comments

I need to know how much risks if you intended to trade directly with the company involved ?

I’m curious too!