LVMH stock – luxury for your portfolio?

September 20, 2020

Shell stock – Goodbye dividend? An oil-giant´s struggle to survive

October 21, 2020| Duerr stock | |

| Logo |  |

| Country | Germany |

| Industry | Machinery |

| Isin | DE0005565204 |

| Market cap. | 2,0 billion $ |

| Dividend yield | 3.2% |

| Dividend stability | 0.79 of max. 1.0 |

| Earnings stability | 0.75 of max. 1.0 |

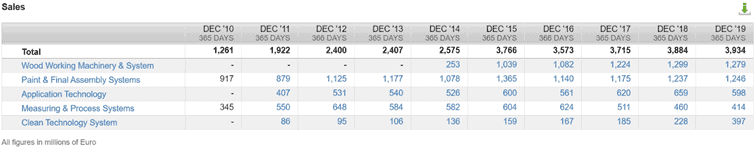

With the Duerr stock you invest in one of the world’s leading machinery and plant manufacturers. Duerr is represented at 112 locations in 34 countries. And today already 45 percent of revenue is generated in the rapidly growing emerging markets. In addition, there is a second trend from which Duerr benefits: the digitization of production. Many companies want to digitize their production to generate information from the collected data to improve efficiency and quality. And it is precisely such systems that Duerr supplies. The keyword here is Industrial Internet of Things (IIoT). And yet the stock price has plummeted by 50 percent within the last three years.

One reason for this is the very strong dependence on the automotive industry, where more than half of sales sits. Whether the Duerr stock is on the verge of a turnaround will be answered in this stock analysis.

The business model: How Duerr earns money

Duerr was founded in 1896 and started with metal work on roofs and facades. Over the years the company developed into one of the leading plant manufacturers worldwide. The company is divided into five divisions, which I will now introduce to you.

Paint and Final Assembly Systems

This segment plans, builds and modernises turnkey paint shops and final assembly lines for the automotive industry. Products and processes for the entire workflow are offered in the paint shop technology. The core competence is the dip painting system. Here the entire body of a vehicle is protected against corrosion by immersion in a special liquid. Duerr has a global market share of 40 percent in the area of paint systems. Digitalisation is implemented and offered to the market through plant monitoring, higher-level factory control options, advanced analytics and predictive maintenance. This means, for example, that a company with a Duerr system knows exactly when it needs to be maintained. All this is known through the evaluation of various sensor data.

In the area of final assembly, Duerr is one of the few suppliers worldwide to offer complete plants. Duerr takes care of layout planning, conception up to the placing of orders with the construction companies. In final assembly, the second major trend besides digitalization is electromobility. Due to the low complexity in the drive trains of electric cars, it is possible to automate the entire assembly process to a greater extent. Their customers also have to convert their plants to be able to produce both hybrid and electric cars. Duerr’s market share here is 25 per cent, which means that the company benefits directly from the trend towards electric mobility.

Duerr’s additional, smaller offerings in this segment include filling and testing technology, wedding stations (body and powertrain are merged) and consulting services for the planning and optimization of production and logistics processes with a focus on electric cars and batteries. Approximately 4,400 employees in this segment generate revenues of just under 1.3 billion EURO.

Application technology

2,300 employees in this segment contribute 600 million EURO turnover with technologies for the automatic spray application of filler, base coat and clear coat. Robot systems are used for this purpose. The global market share amounts to a proud 50 percent. Tesla also equips its factories with painting robots from Duerr.

The main competitors in this segment are manufacturers of standard industrial robots. In addition to paint application technology, the company operates in two similar areas: sealing and adhesive technology. Sealing technology is used to seal weld seams, for example. Adhesive bonding technology is becoming more and more important because it makes it possible to bond lightweight materials in car construction that cannot be welded. Panes, glass roofs, cockpits and tanks are also glued in the final assembly.

Clean Technology Systems

This segment is mainly active in exhaust air purification technology. Duerr manufactures systems for the chemical, pharmaceutical, printing, mining, oil and gas industries. The most important product is based on the thermal oxidation process. In this process, pollutants are burned at up to 1,000 degrees Celsius. The product range also includes sound insulation systems and coating plants. In 2018 Megtec/Universal was taken over. Duerr thus has a world market share of 25 percent. The 1,400 employees are good for revenues of around EUR 400 million.

These three segments are managed under the Duerr brand. In addition to the main brand, there are two other brands: Schenk and Homag. The two brands have emerged from acquisitions and will be continued as an independent segment.

Measuring and Process Systems

This segment is somewhat smaller and generates a turnover of around 240 million EURO with 1,400 employees. Balancing and diagnostic technology, as well as solutions for automated filling and refrigerators, air conditioners and heat pumps with refrigerants are manufactured and sold. Duerr has a market share of 45 percent in this rather small segment. This business unit was already established in 2000 following the acquisition of Schneck and will continue to operate under this brand.

Woodworking Machinery and Systems

This segment was only recently integrated into the Duerr Group. It was created from the acquisition of HOMAG Group AG in 2014 and manufactures and successfully markets machines and systems for woodworking with a global market share of 30 percent. The products are used in the furniture industry and in craft for the production of various types of furniture, kitchens, parquet flooring and windows, as well as doors. The product range is very broad and extends from simple entry-level machines to fully automated lines for mass production. With around 6,500 employees, it is the largest segment and accounts for 1.3 billion EURO in turnover. In my opinion, HOMAG was a very good addition to Duerr, as it enabled the company to reduce its high dependency on the automotive industry.

However, the automotive industry continues to account for 53 percent of total revenue, while 33 percent of revenues are coming from the woodworking industry. The remaining 14 percent of revenues are earned in general industry.

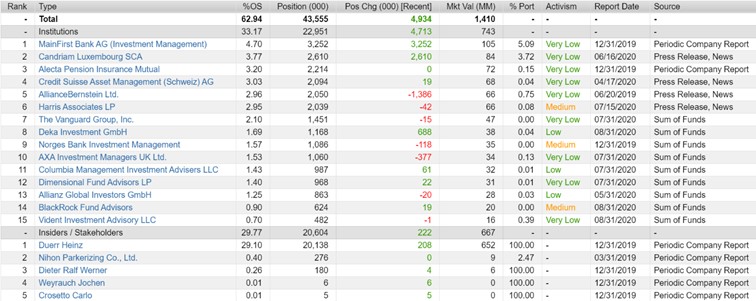

The Duerr founding family as anchor stockholder

The founding family continues to hold a total of 29.1 percent of the Duerr Group and thus has a considerable power in long-term decisions. I consider it positive when companies are family-owned. The company management does not run the risk of being harassed by an activist investor and is not dependent on the short-term investment horizon of other investors. The influence of the founding family benefits a long-term corporate strategy that focuses on sustainable growth and thus also sustainably increasing dividends.

The objectives of the management

The medium-term goal of Duerr management is an EBIT margin of 8 percent and organic revenue growth averaging 2 to 3 percent. Duerr is also focusing on creating an attractive return on capital and is aiming for a return on capital employed (ROCE) of at least 25 percent. The reason for this high return is the relatively low level of capital tied up in plant engineering. ROCE shows whether the capital employed is generating an appropriate return. Capital employed is calculated from all asset values excluding cash and cash equivalents and financial assets, less non-interest-bearing liabilities. EBIT is divided by capital employed to obtain ROCE. ROCE also shows whether the company can earn its cost of capital. Duerr defines the cost of capital in terms of the WACC (weighted average cost of capital) of 8.4 percent and achieved a ROCE of 16.9 percent for 2019 as a whole. However, the figure in the Corona crisis fell to just 2 percent in the first half of 2020. An alarming sign in my eyes because the company is barely earning its cost of capital. Should this not increase in the near future, liquidity or loans will have to be used to cover the cost of capital.

In addition to the financial targets, the management intends to further strengthen the service business. On the one hand, margins in the service business are higher and, on the other hand, service revenues are more predictable than individual orders. The service business includes the maintenance of plant and machinery for instance.

Digitization as a central strategic element

To maintain its strong market position, Duerr has quadrupled its spending on research and development (R&D) over the last 10 years. The first IIoT-Plattform specifically for mechanical and plant engineering was a great success. Industrial Internet of Things means that machines and plants are equipped with various sensors. The data obtained from the sensors is then sent to a platform. On this platform the status of the machine can be seen, for example whether maintenance is required or whether efficiency improvements are possible so that process quality can be improved. The sensors required for this are already installed in the systems supplied by Duerr and provide the customer with additional added value in addition to the core product.

This is how profitable Duerr’s business model is

Duerr’s business model is exciting because it benefits both from electromobility and from the rapidly advancing digitalization.

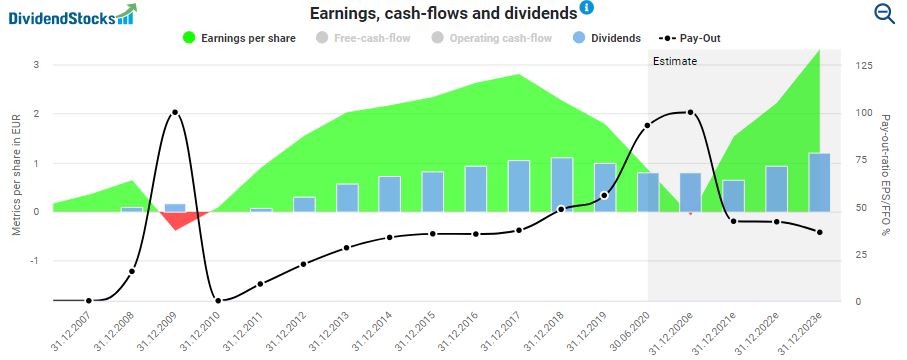

However, profits do not grow from bottom left to bottom right, but fluctuate strongly over the years. The same can be observed with dividends. After a cut, the dividend rises again in step with profits, and as soon as profits collapse again, dividends are also threatened. It will be interesting to see whether the analysts are right and whether a dividend will continue to be paid out in 2021. The current payout rate is 100 percent. This means that the dividend will not be financed from current business, but rather from cash and cash equivalents and credits.

Especially in the financial crisis of 2009, the kink in the result was particularly strong. Before the acquisition of HOMAG AG, Duerr was even more dependent on the automotive industry. The takeover enabled Duerr to secure some stability, but it should not be forgotten that it is still a plant engineering company and earnings will continue to be cyclical. Years of negative earnings cannot be ruled out and you should continue to expect them in the future, as 53 percent of revenue continue to come from the automotive industry.

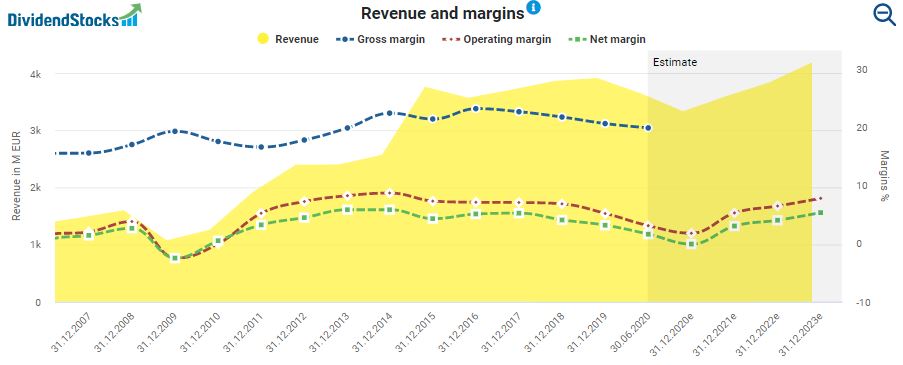

How revenue and margins develop

The development of turnover is somewhat more stable than the development of profit. Duerr is struggling with the problem of falling margins due to increased competition from suppliers, especially from the Asian region. Uncertainty about the trade conflict between the USA and China is also weighing on business. The Woodworking Machinery and Systems segment in particular is having to contend with significant declines in revenue in high-margin Chinese business and high increases in material and personnel costs. Management was unable to tackle the problem of falling margins despite the cost-cutting measures implemented, and now the global economy is also shaking due to the corona pandemic. This is no easy environment for more profitable business.

Is the dividend of Duerr stock secure?

As a classic cyclical company, not only profits fluctuate, but also the dividends. The dividend had to be completely cancelled in 2010 and cut in the Corona crisis year 2020. In order to better classify the current dividend yield, I use the dividend turbo on DividendStocks.cash.

Duerr pays a dividend once a year. The last dividend amounted to EUR 0.80 and was paid on May 29, 2020. The current dividend yield is 2.96 percent, which is at the lower end of the 12-month dividend zone. During the corona crash in March, however, a dividend yield of up to 5.75 percent was possible! This example shows one of the strengths of DividensStocks.cash. By combining current key figures and charts, it is possible to identify particularly high dividend yields in a historical comparison and thus to obtain a first indication of an undervalued dividend stock. Of course, a high dividend yield should not be the only criterion for buying a stock. After all, what is the point of a high dividend in the short term if it is cut or even cancelled completely next year? Therefore, a more in-depth analysis of the company is necessary. Primarily the development of amortization power and debt are important key figures, which I will now go into in more detail.

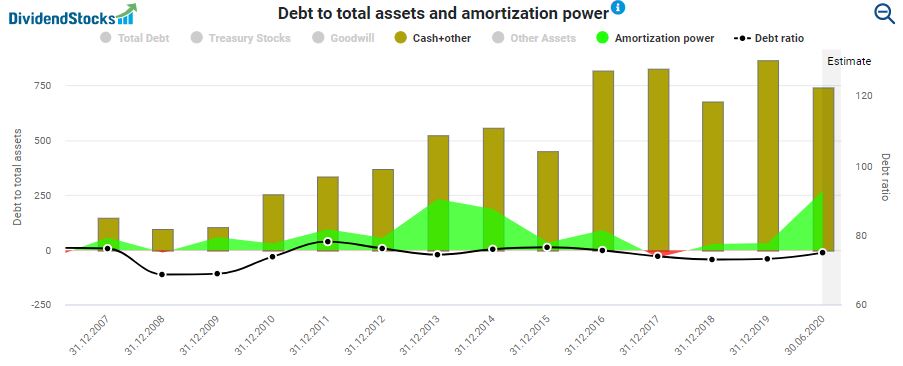

The chart shows that Duerr has built up a substantial cash in recent years. High cash reserves allow certain independence from creditors and allow the company to strike quickly when attractive takeover opportunities arise. The debt ratio has been hovering constantly between 72 and 78 percent since 2011. The low fluctuation is also to be seen as positive. Nevertheless, the debt ratio has reached a level that should not be exceeded. Fortunately, the debt repayment period is “only” 10.6 years. This means that it would take Duerr just under 11 years to repay the entire debt by the annual cash flow generated.

Is the Duerr stock fairly valued?

You are aware of Duerr’s exciting business model, as well as the potential risks associated with dependence on the automotive industry and Duerr’s classification as a cyclical company. To calculate the fair value, I use the adjusted profit and the dividend in the Dynamic Stock Valuation.

Valuation of the Duerr stock using the dynamic stock valuation

The fair valuation based on adjusted profit gives a fair value of EUR 22 for the first half of 2020. At the end of June the stock price was almost exactly at the same level. The fair value drops to a few euros, as analysts expect the profit for the full year to be only just positive. Due to the current dividend, the Duerr stock is slightly undervalued. Even with a further dividend cut, the stock price is almost at the fair value. With a current investment, price gains are not expected until 2022, as the raise in profits will not be very fast. Although the fair value calculation for the near future indicates that the Duerr stock is overvalued, an annual return of 12.5 percent would be expected in 2022 (red dotted line) following the recovery in earnings forecast by analysts. The right time to buy seems to be relevant for the Duerr stock. With this in mind, I would like to present an exciting concept.

Excursus: Peter Lynch Categorisation of companies

Peter Lynch managed the Magellan Fund from 1977 to 1990, generating annual returns of 30 per cent. After leaving the fund, he wrote several investment books, including the bestseller “One Up on Wall Street“. In this book he stockd his basic investment philosophy. The core of his philosophy is based on the division of companies into six categories:

- Slow Growers (slow growing companies)

- Stalwarts (companies with medium growth)

- Fast Growers (fast growing companies)

- Cyclicals (Cyclical)

- Turnarounds (companies on the ground and close to an upswing)

- Asset plays (companies with hidden assets)

I think this classification of companies is very helpful, as each of the categories mentioned is subject to different drivers. When analyzing stocks, it is important to consider the right analytical aspects. If you are interested in the details of all categories, I recommend the book or one of the countless helpful blogs on this topic, such as Guru Focus. Duerr can clearly be placed in the category of cyclicals. Cyclicals are characterised by the fact that revenue and profits fluctuate with the (economic) cycle. These companies should be bought when a low is reached. The low can be identified when the P/E ratio is particularly high or negative because the company is generating very low profits or even losses. Many short-term oriented investors lose confidence in the company due to falling profits. The stock price can fall very sharply in a short period of time. This is exactly the ideal time to enter the market. This is because cyclical stocks are characterised by the fact that they recover from a slump. For a long-term investment, on the other hand, they are rather poorly suited because price gains are regularly lost and rising dividends are cut again at some point. However, at the right time, the purchase of such stocks can be profitable. In the best case, the stock is sold when it has reached the peak of the current cycle and is about to cool down.

Conclusion: The Duerr stock as a cyclical buy

The Duerr stock is exciting because the company has secured high shares in the world market and is benefiting from megatrends of electromobility and digitization. Nevertheless, Duerr remains a cyclical investment and should, in my opinion, be treated as Peter Lynch describes it for cyclical investors. Buy at the lowest point and sell at the highest possible price after the turnaround.

With a forecast annual return of 12.5 percent, the Dynamic Fair Value calculator also indicates a buying opportunity. If you are not a buy-and-hold investor and not deterred by the risk of a cyclical downturn, the Duerr stock could be a buy for you. If profits pick up again in the next few years, the old high of 60 EURO could be reached again, which would mean a doubling of the stock price.