Henkel Stock – Ready for a turn-around and 2.4% Dividend !?

August 31, 2020

Allianz Stock – A 5.3% Dividend Insurance ?

September 12, 2020Almost every investor knows Berkshire Hathaway. After all, it is the company of Warren Buffett who is considered to be one of the greatest investors of all time. Under his leadership, Berkshire has become one of the most valuable companies in the world and has made him a multi-billionaire. This success has made the Berkshire Hathaway stock very popular with private and institutional investors, even though the stock does not pay a dividend. Berkshire Investors want to benefit from Buffett’s expertise. The stock also offers excellent diversification since Berkshire is a holding that is invested in a wide variety of different companies. Whether the Berkshire Hathaway stock belongs in your portfolio or Buffett has lost his edge, you will find out in this stock analysis.

The business model: How Berkshire Hathaway generates money

Berkshire is a so-called “Holding” company. A holding solely invests into and manages a multitude of other companies and does not engage in any business activity itself. Berkshire Hathaway does not sell its own products or services but earns a profit by investing in other companies. Berkshire also has majority stakes in many businesses. The revenues of those majority-owned businesses are counted as Berkshire´s revenues. Berkshire is invested into dozens of companies and is very well diversified as a result. Warren Buffett invests in both private and publicly-traded companies. While the acquisition of public companies through stock purchases is open to anyone, normal individuals usually cannot invest in private companies. However, by investing in Berkshire Hathaway, you can indirectly own the stocks hand-picked by Warren Buffet.

| Berkshire Hathaway stock | |

| Logo | |

| Country | USA |

| Industry | Holding |

| Isin | US0846701086 |

| Market cap. | 526,7 billion $ |

| Dividend yield | – |

| Dividend stability | – |

| Cash-Flow stability | 0.94 of max. 1.0 |

Berkshire Hathaway also owns some very large companies entirely. One example is the BNSF Railway Company as a direct competitor of Union Pacific. BSNF is fully owned by Berkshire.

Value Investing

Warren Buffett is a so-called “value investor”. This strategy involves buying a company below its intrinsic value. The difficulty here lies in estimating this fair value. If you estimate it incorrectly, you may end up paying too much for a stock. To maximize your profit, you must buy a stock with the largest possible discount to its fair value. Once the market realizes the true value of the stock and the price increases, you can sell it for a profit. You often need patience for this strategy. While waiting for the market to reprice the stock, you can collect dividends if the company pays those.

The Portfolio of Berkshire Hathaway

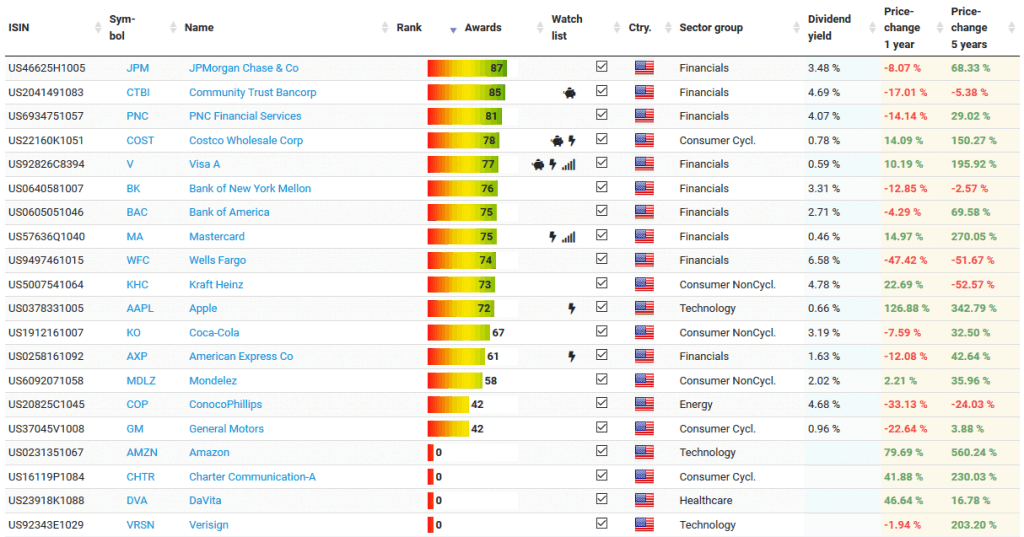

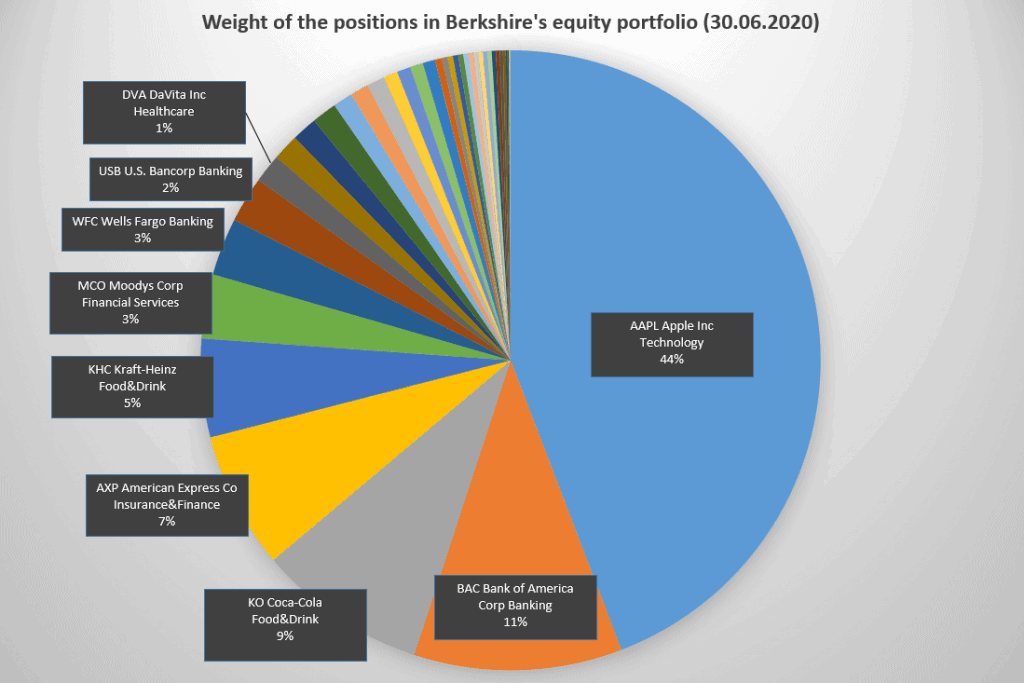

Warren Buffett usually holds his investments for the long term, and his preferred holding period is “forever”. The only way to achieve high returns over a long period of time is to buy stocks of high-quality companies that increase their profits over the years. Warren Buffett focuses on various industries. Very often represented in the portfolio are banks and financial service providers, such as Bank of America and Visa. Berkshire also likes to invest in consumer goods companies such as Procter & Gamble. In recent years they have also invested in technology companies such as Apple and Amazon. In addition, there are companies from other industries, which means that the portfolio is well diversified. Let us now take a closer look at the constituents of Berkshire’s portfolio:

The largest positions in Berkshire’s portfolio of public companies (Source: Fintel.io)

Like Buffett, we also look for quality companies with rising profits. On Dividendstocks.cash, you can check how well Buffett’s investments are performing. The ranking reflects the long-term growth of revenues, profits and cash-flows:

Top 3 investments

Apple

| Apple stock | |

| Logo |  |

| Country | USA |

| Industry | Technology |

| Isin | US0378331005 |

| Market Capitalization | 1965,2 billion USD |

| Dividend Yield | 0.7% |

| Dividend Stability | 0.90 (max. 1.0) |

| Earnings Stability | 0.95 (max. 1.0) |

It’s surprising, but by buying the Berkshire Hathaway stock, you are investing a large part of your money into Apple! The Apple stock makes up 44 Percent of Berkshire’s portfolio, because of the enormous price increase in the last couple of months. Since the Corona crash in March 2020, the price of Apple stocks has more than doubled. An incredible increase within a few months.

The market value of Berkshire’s Apple position has risen to USD 122 billion. Unfortunately, the diversification suffers because the Apple investment now accounts for a large part of the portfolio value. Regardless of this, I do not expect Buffett to sell the stock. After all, he has called Apple the best company in the world.

Bank of America

Warren Buffett is a big fan of banks. Berkshire’s portfolio includes many bank stocks, with Bank of America being by far the largest position. This major bank is Berkshire’s second largest investment after Apple and accounts for 11 percent of the total portfolio. The other banks Wells Fargo, Bank of New York Mellon and JP Morgan Chase on the other hand, are only in the low single-digit range. Although the BofA stock could not keep up with Apple’s performance over the last 5 years, it still achieved a decent 58 percent return.

Coca-Cola

| Coca-Cola stock | |

| Logo | |

| Country | USA |

| Industry | Beverage |

| Isin | US1912161007 |

| Market Cap. | 214.9 billion $ |

| Dividend Yield | 3,2% |

| Dividend Stability | 1.0 (max. 1.0) |

| Earnings Stability | 0.83 (max. 1.0) |

Warren Buffett has been invested in the beverage giant Coca-Cola since 1987. He values the company not only as an investment but is also a big fan of the Coca-Cola beverage. In interviews he has often told people that he drinks Coca-Cola every day and at the annual general meeting of Berkshire, Coca-Cola bottles are on Buffett’s table. The Coca-Cola stock is a solid dividend payer and Berkshire has been collecting those dividends every quarter for several decades.

Even Warren Buffett makes mistakes

You should not rely entirely on Warren Buffett and assume that all of his investment decisions are outperformer. Even an expert like him makes mistakes from time to time, just like you and I. A prominent example in recent years is Kraft-Heinz, which lost a lot of value in 2019 following a subpoena from the SEC. The SEC had been skeptical of their accounting practices. Kraft-Heinz was able to resubmit corrected versions of the problematic documents, but a bad taste remained in one´s mouth. Shortly afterwards, Warren Buffett admitted in an interview that he had paid too much for the stocks of the food giant. Kraft-Heinz has also repeatedly slipped into the red in recent years and has not managed to sustainably increase its profit and cash flow.

Buffett had to experience another pushback with airlines this year. The Corona Pandemic hurts the business model and poses a threat to the existence of some companies. Berkshire therefore jumped ship in May and sold all airline stocks in the portfolio.

These examples show the reality of being an investor. As important as thorough research and common sense are, there are always situations, such as the Corona pandemic, that cannot be foreseen. This is why diversification is so important. Since Berkshire Hathaway has dozens of companies in its portfolio, you are well diversified, similar to an index fund. Moreover, the profits made from gainer stocks usually outweigh the losses from the losers. With the investment in Apple, Buffett has compensated the losses from Kraft-Heinz many times over.

Operating subsidiaries

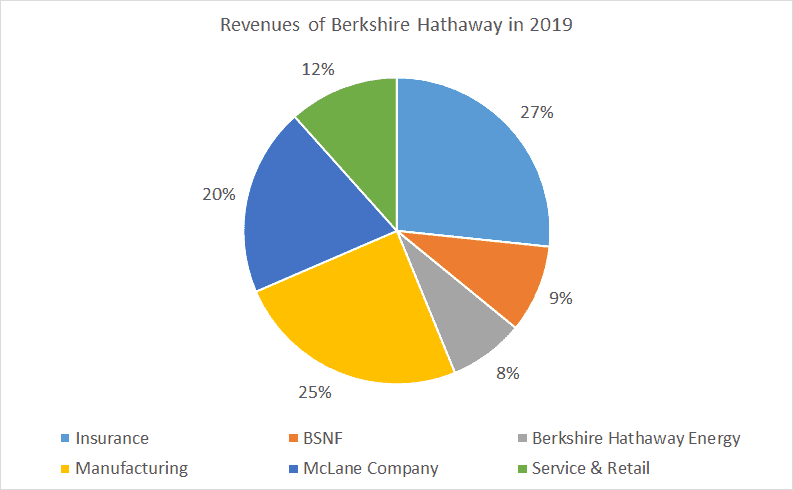

Only revenues generated by the companies that are majority-owned or wholly owned by Berkshire are included in the revenue numbers (page K-71f). The profits and losses from the investment portfolio only play a role in determining the final profit. It is not very informative to put the profits from private and public investments in relation to each other, as the profits from the equity portfolio vary greatly from year to year and are usually unrealized gains.

However, it is possible to create an overview of the different revenue contributors. As you can see in the chart, Berkshire generates most of its revenues from insurance companies, closely followed by industrial companies and the McLane Company, which is a logistics company. Interestingly, BNSF is the hidden champion of the group. Although BNSF is only responsible for 9 percent of revenues, it contributes 25 percent of the operating profits (page K-109).

How profitable is Berkshire Hathaway?

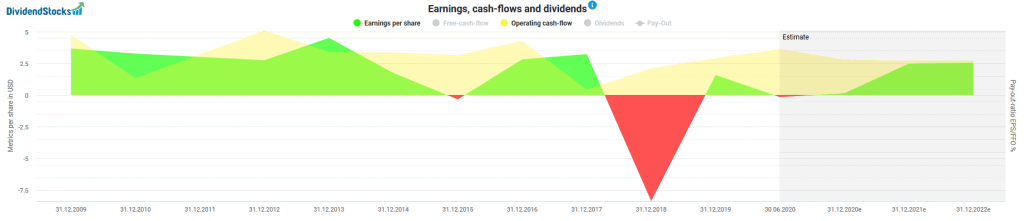

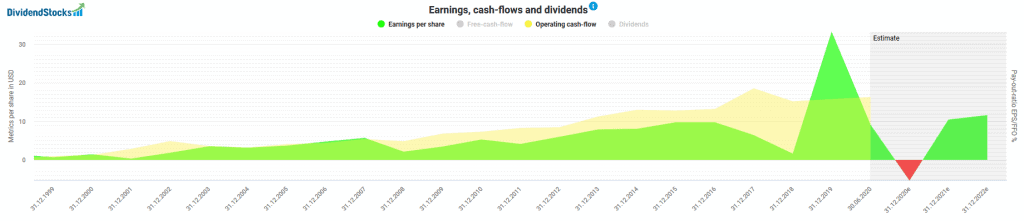

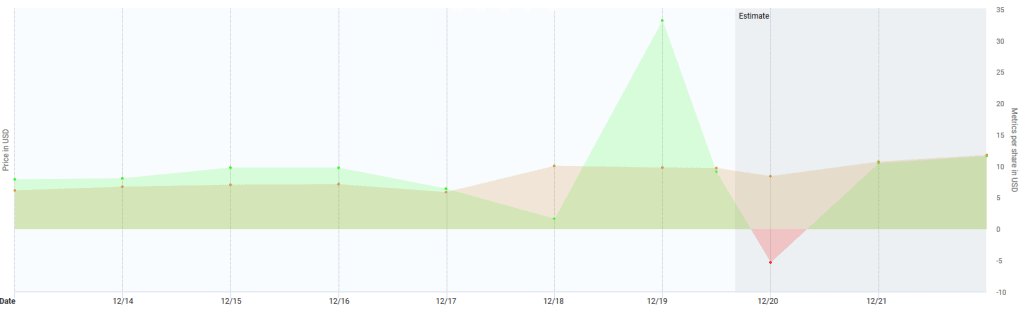

As you can see in the chart below, Berkshire’s earnings per share have fluctuated significantly in recent years.

This is the result of an accounting rule that requires Berkshire to count unrealized gains/losses in its portfolio as actually profits/losses. If the portfolio increases in value, Berkshire will report a profit for that time period. The opposite is true when the portfolio declines in value. To reiterate, profits are counted when a stock increases in value, not when it is sold. Since the stock market can be very volatile, the profits also fluctuate. For the current fiscal year, analysts are even forecasting a loss as a result of the corona pandemic. These losses are usually of short-term nature and do not always correctly reflect the actual business performance of the investments. You can see this by looking at the adjusted profit. The adjusted profit of Berkshire has been constant in recent years, although the reported profit has had some extreme ups and downs.

Cash flow, on the other hand, is not affected by unrealized gains and losses. For this reason, it often stays constant during periods when profits fluctuate strongly. If you take a look at the cash flow above, you will notice that the underlying business is actually much less susceptible to fluctuations than the reported profit numbers would suggest. When profits plummeted in 2018, the cash flow hardly decreased at all. The same was true in 2019, when the cash flow remained unaffected by the increase in profits. The reported profit is still a valid indicator of the long-term success of a business. However, you should always question the reason for short-term fluctuations.

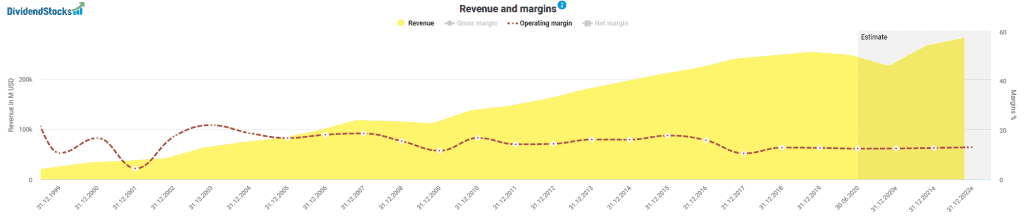

Berkshire has grown its revenue quite well in recent years. In 2015, revenues totaled USD 210 billion. By the end of 2019, that number had increased to USD 255 billion. This represents an annual increase of 5 percent. Due to the pandemic, a decline is expected in 2020. According to a UBS analyst, the companies Precision Castparts, a manufacturer of aircraft parts, the chemical company Lubrizol, and the manufacturer of prefabricated houses Clayton Homes are strongly affected. These companies are fully owned by Berkshire Hathaway. Airlines are also suffering from the pandemic, as air traffic has been reduced to a minimum. As a result, Berkshire has sold all its airline stocks.

However, according to forecasts, revenues will immediately rise again in the following year and even exceed the level of 2019.

In contrast to sales, the operating margin has not increased in recent years, but has remained largely constant. It is also lower than it has been in previous years and no improvement is expected in the coming years.

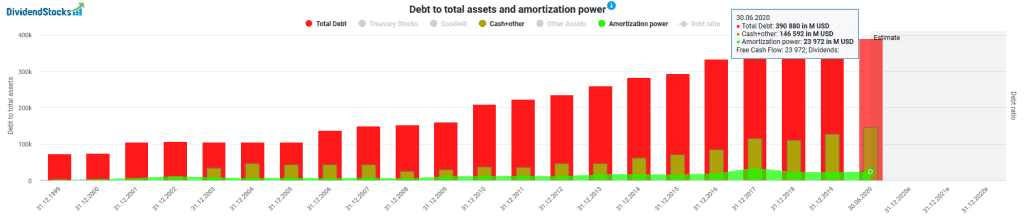

147 billion in cash

Berkshire is currently sitting on more cash than ever before. At the end of June, the cash reserves totaled USD 147 billion. The cash position acts as a safety net and also provides the necessary funding for any future acquisitions. Opposite of the liquid reserves are liabilities of USD 391 billion. Berkshire has no difficulty in generating cash flow, as evidenced by the fact that they have had positive free cash flow for over 2 decades. You can see that from the amortization power in the chart below(green bars). Since Berkshire does not pay a dividend, the entire free cash flow remains on the balance sheet. In the last 12 months, Berkshire has generated nearly USD 24 billion in free cash flow. With such a large surplus, it’s not surprising that the cash balance has been increasing for years.

Buffett in Japan

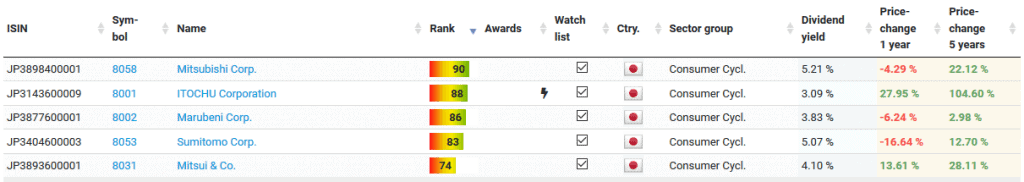

On Monday 31st August, Berkshire announced that it had acquired 5+ percent stakes in the following 5 Japanese trading companies: Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo. The companies trade in a wide variety of goods, including food, textiles and metals. The total investment amounts to USD 6.25 billion. This represents approximately 2.4 percent of Berkshire’s portfolio. Berkshire stated that they consider these purchases long-term investments and might increase their stakes up to 9.9 percent.

I think Warren Buffett sees a great opportunity in these companies. Otherwise he probably would not have made such a concentrated investment in 5 companies in the same industry and country in such a short time period. By the way, you can find all 5 companies on Dividendstocks.cash:

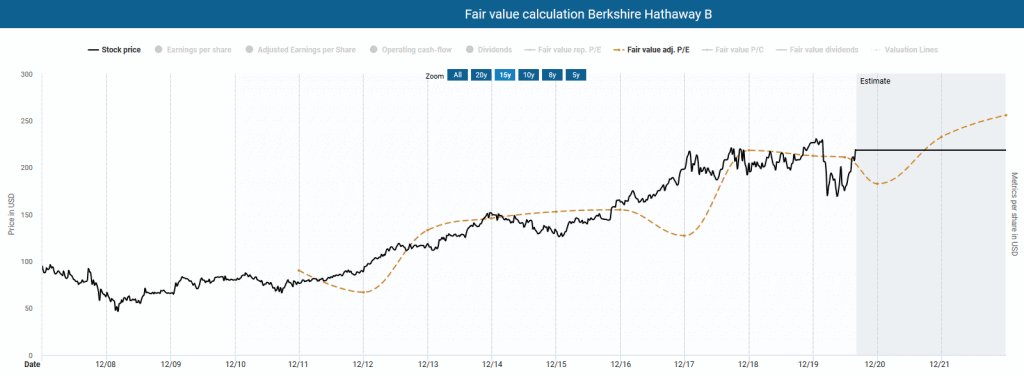

Is the Berkshire Hathaway stock fairly valued?

Determining the fair value of the Berkshire Hathaway stock is a more difficult task than it is for other companies. In order to determine the value of Berkshire, one would theoretically have to determine the fair values of all the companies that Berkshire owns and add them all together. The resulting sum would then be the value of Berkshire Hathaway. In reality, this method turns out to be very difficult and impractical. The values of the public companies could be determined by taking their respective market caps. However, there is no exact market value for the companies fully/majority owned by Berkshire, because they don’t trade on an exchange.

I don’t consider the reported profit to be a viable valuation metric either. Due to the fluctuations, the fair value based on the reported profit is not meaningful. However, this has only been the case since 2017. In times of low volatility, the profit-based fair value can be helpful.

In my opinion, the fair value based on adjusted profit is the best valuation metric for Berkshire Hathaway. I choose a 10-year valuation period starting in 2010 to obtain a long-term average. According to this method, the stock seems to be fairly valued right now. Adjusted earnings are expected to decline slightly this year, but will recover immediately in the following year.

Despite the lack of a discount, I consider the stock to be a good buying opportunity. This is because the rapid rise in Apple’s stock price is not yet included in this data. As a result, the Apple shares in Berkshire’s portfolio are now worth considerably more than they were a few months ago. This means that you get the Berkshire Hathaway stock at a fair price and are also indirectly invested in Apple without having to pay a high premium for that.

Berkshire A or B?

Berkshire Hathaway has two different share classes. There are the “A” shares, which have never been split since their initial issue. This “A” share has become the most expensive stock in the world and costs more than USD 320 000. Since this would make Berkshire inaccessible to retail investors, there is also another less expensive share class. The “B” share represents a much smaller part of the company (1500 “B” shares equal one “A” share) and is therefore also much cheaper. Through this “B” share you can invest in Berkshire.

Conclusion: The Berkshire Hathaway stock – a solid foundation for your portfolio

Despite the large weighting of Apple, the Berkshire Hathaway stock is not a tech stock with a high risk, high reward profile. Rather, the stock is a conservative investment that offers good diversification. Instead of paying a dividend, Berkshire invests the money to expand the portfolio. In my opinion, Berkshire is comparable to an index fund. Whether the stock performs better than a specific benchmark depends on the time period and index. I believe the stock is currently fairly valued based on a historical adjusted-earnings multiple. Thanks to the overall high quality of the investments and an impressive track record of the Buffett Management, I believe the stock is a good foundation for every portfolio that is not reliant on dividends.