Amazon Stock – 8000% performance ! Sky is the limit ?

July 2, 2020

Realty Income stock – 5% dividend in monthly rates – How much longer?

July 10, 2020The Salesforce stock price has gained nearly 4,000 percent over the last 15 years. After stagnating somewhat in 2019, the share has started its turbo again this year and is now, despite a major COVID 19 setback, above the previous all-time high of February 2020.

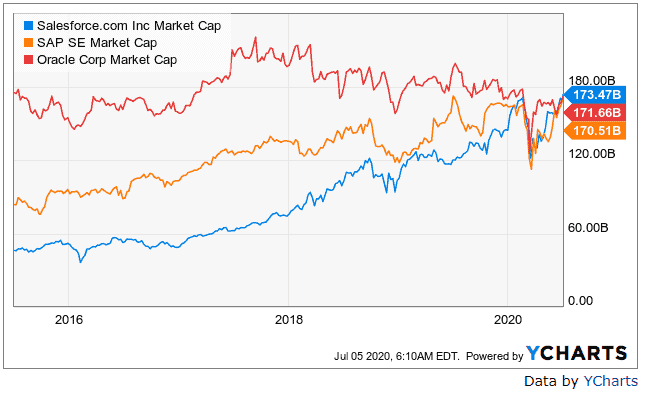

Overall, the rising stock price reflects the company’s success because, in terms of revenue, Salesforce is one of the fastest-growing companies in the world. The excessive stock price gains have also driven market capitalization so high that Salesforce, at $173 billion, now has a higher market capitalization than its main competitors SAP and Oracle.

Market cap Salesforce, SAP, Oracle (Source: YCharts)

What’s the secret to Salesforce’s rapid revenue growth? Will the company outperform its competitors, or has it already reached the limits of growth, making Salesforce stock hype and overvalued? No worries, we will cover all aspects in this stock analysis.

| Salesforce stock | |

| Logo |  |

| Country | USA |

| Industry | Internet |

| Isin | US79466L3024 |

| Market cap. | 175,2 billion $ |

| Dividend yield | – |

| Dividend stability | – |

| Cash-Flow stability | 0,91 of max. 1.0 |

Salesforce’s business model

Salesforce is already bringing joy to nerds and fun fact junkies with its New York Stock Exchange ticker “CRM”, which is also the abbreviation for the core market in which the company operates (CRM = Customer Relationship Management). Speaking about CRM, Salesforce’s CRM business covers several market segments, as Salesforce has added more and more components, services, and products to its core competence through acquisitions. Instead of listing the individual segments, I’ll give you a better overview of the company’s business and success by showing you what exactly the company offers and then how it provides its products and services to customers.

CRM and Cloud – an undefeatable combination

As already mentioned, Salesforce is active in CRM, the so-called customer relationship management, or customer care. Why is customer care so important for companies? The answer to this question is strongly related to the acquisition of new customers and the marketing and advertising costs required for this, which are usually higher than the costs that a company has to spend on retaining existing customers. The reason for this is apparent. With existing customers, a company already has essential information, such as their name and address, and their behavior. With each additional product or service purchased, an even more detailed picture of the customer’s needs emerges, which puts the company in an increasingly better position to satisfy its customers’ needs and to tailor an offer to the specific customer’s requirements. The incentive for companies to retain existing customers is correspondingly strong.

However, the added value of customer care does not stop at existing customers. Companies can use the knowledge and data gained from their customer relationship management to acquire new customers, for example, by analyzing existing customers’ behavior and designing comparable offers for new customers. Likewise, a company can channel marketing costs more effectively if it knows which customers to address. Converting a potential customer who is interested in buying to a customer who is truly buying is much easier and cheaper. Accordingly, companies need to operate a functioning and efficient CRM. And this is precisely the secret of Salesforce’s success.

Salesforce – The secret to success

To understand Salesforce’s success, you need to take a step back in time to the early days of digitization. At the end of the last millennium, companies practiced CRM, marketing, and new customer acquisition essentially analog. Only individual software solutions brought relief and gradually shifted the CRM business to the digital world.

The problem with software solutions that were widespread at that time, such as those offered by SAP, was their complexity: It had to be installed on a computer, could only be used there, and had to be managed there as well, for example, by adding updates. Similarly, the individual products were not very well adapted to the individual needs of customers, because small and large companies used the same program. Salesforce recognized the problem and, with CEO Marc Benioff, filled a huge gap in the market by moving to the cloud early on and, if necessary, buying the required expertise through acquisitions. Today, Salesforce offers most services and products through a single cloud, the Customer 360 Platform.

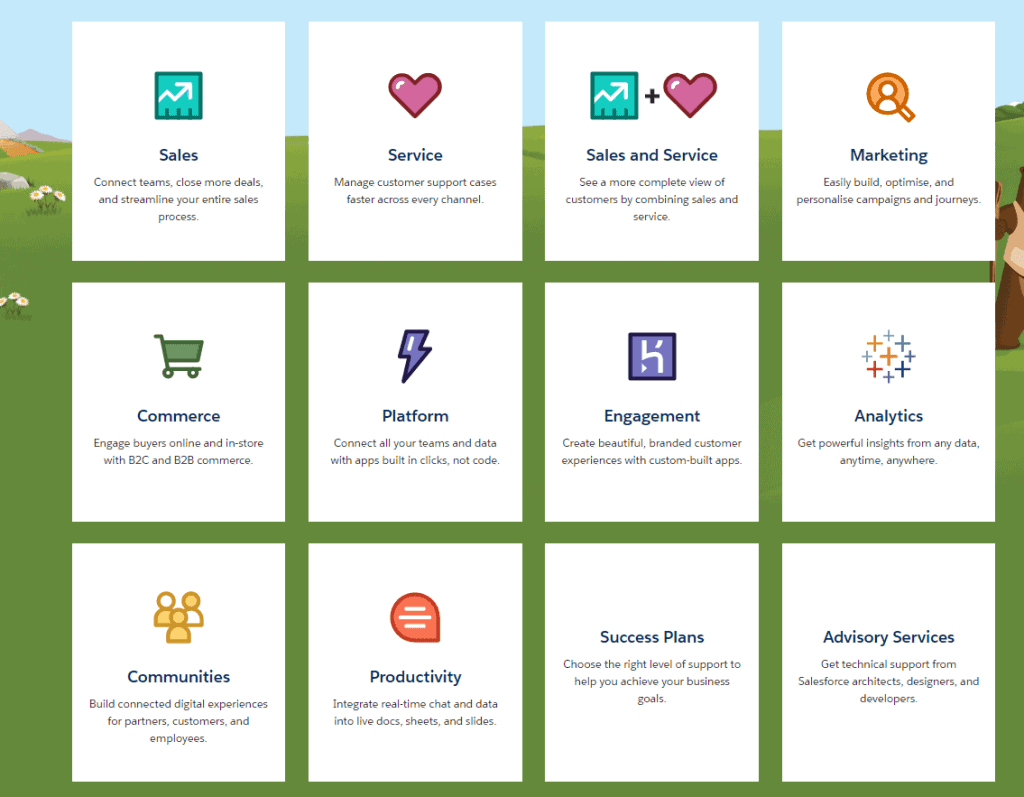

Most Salesforce applications run on the cloud-based Customer 360 platform (https://www.salesforce.com)

The individual services and products are primarily PaaS (Platform as a Service) and SaaS (Software as a Service) solutions based on cloud computing. As already explained in more detail in our Amazon analysis, the cloud computing market is multi-layered. In PaaS, Salesforce offers programmers and developers a complete software and programming environment alongside a hardware infrastructure. For example, Heroku, a company that Salesforce purchased in 2010 for just over $212 million, provides developers a cloud-based platform on which they can build their apps in any open source programming language.

The second significant segment in which Salesforce is active is SaaS. Here, the company sells cloud-based software solutions or apps it has developed in-house to mainly commercial end-users (so-called B2B area=Business to Business). The nature of cloud solutions also explains why Salesforce is growing so rapidly in the CRM space.

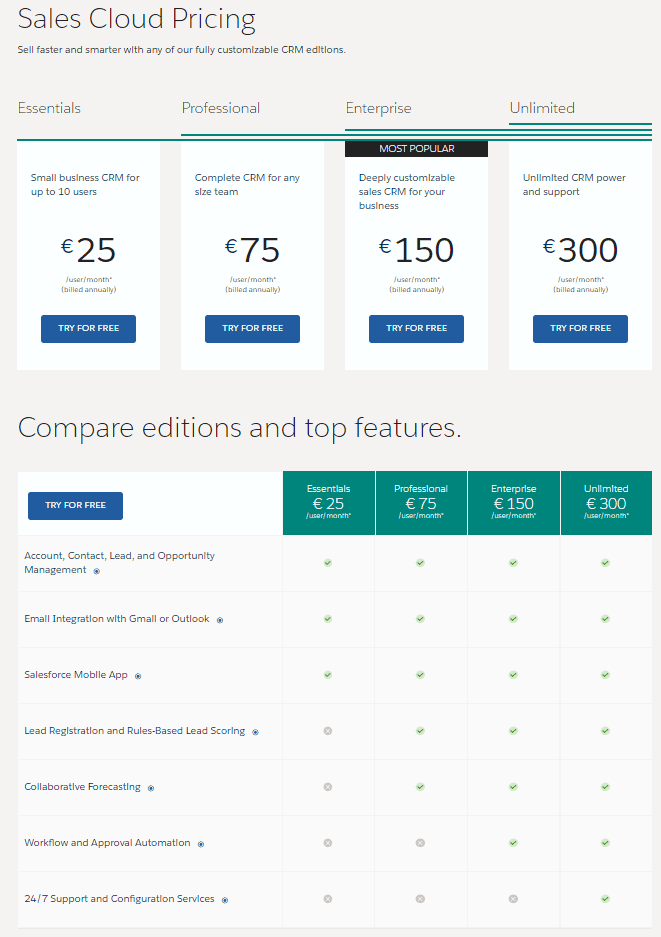

Companies develop at different pace, have different flexibility and individual ideas about their customer care and marketing. Cloud solutions are something like a Swiss Army knife of IT-Infrastructure. They don’t have to be installed everywhere on every computer but are accessible from everywhere. The provider takes care of updates, further development, and (critical!) security, while the customers can fully focus on the growth of their business. Besides, individual applications can be combined and expanded as desired. Customers can decide for themselves which products they need and to what extent. For example, Salesforce offers the modules Marketing (e-mail campaigns, SMS marketing, push notifications, evaluation functions, etc.), Customer Service (webchat, ratings, etc.) or Sales (contact management, task planner, invoicing, etc.). The pricing model of Salesforce’s Sales Cloud, which gives companies access to individual or entire customer data and orders, gives you a good picture of the different functionalities and the resulting price differences:

Salesforce products are extremely scalable and offer many key features, especially for fast-growing companies (https://www.salesforce.com)

What the future has in store

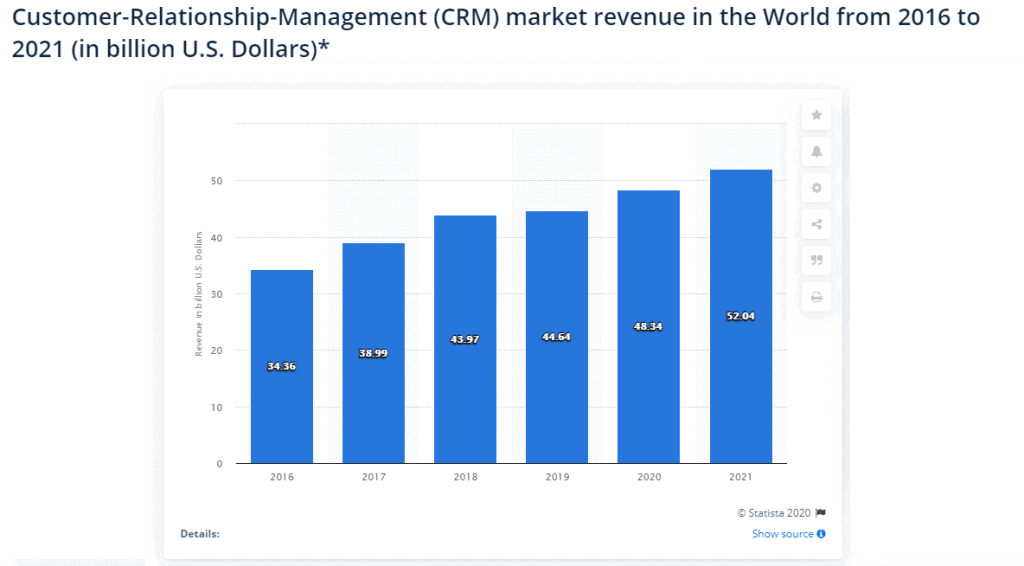

Salesforce is benefiting massively from the fact that its biggest competitor, SAP, has missed the transition from software to cloud-based applications. As a result, Salesforce has slowly but surely become the absolute market leader. While the former market leader SAP has a market share of just 8 percent and is struggling with declining shares, Salesforce has been able to expand its share to over 18 percent, with a steady upward trend. The signs that growth will continue in the coming years are positive. For example, the CRM market is one of the fastest-growing markets in the already enormously growing cloud computing market.

Customer-Relationship-Management market revenue in the World from 2016 to 2021 (Source: Statista)

Geographically speaking, the company also still has considerable growth potential. I see the European market and Asia in particular as future growth drivers for the company. The European market volume is currently $9 billion and Salesforce’s market share of $1 billion generated in Europe is significantly smaller (approximately 11 percent) compared to the global market share of over 18 percent.

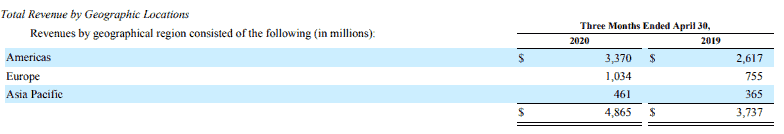

Total revenue by geographic locations (SEC Filing)

Salesforce is a revenue engine

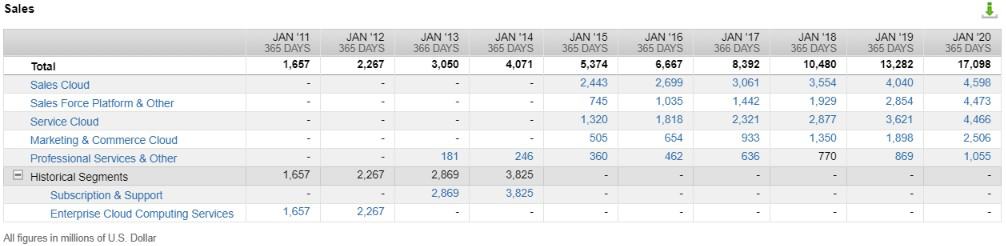

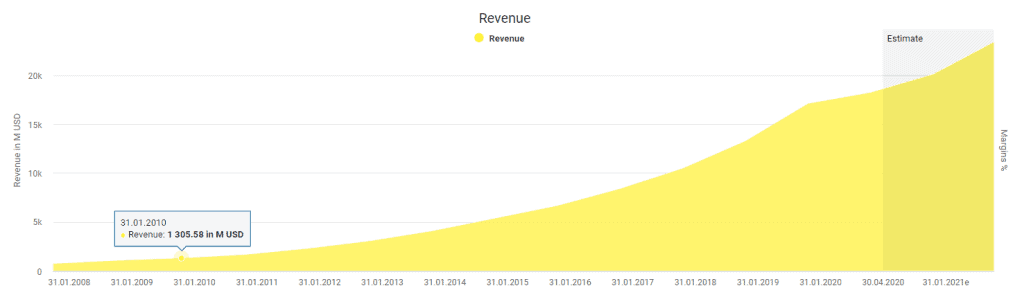

The chart below shows how Salesforce’s revenue growth is consistently around 25 percent per year. While revenue was just under $1.3 billion in 2010, it’s expected to reach nearly $21 billion in fiscal 2021. In this case, it would have increased by a factor of more than 16 within ten years.

Growth is expected to continue in the future. The fundamental development of the CRM market and its outstanding importance for companies make this assumption likely. In particular, the increasing market share indicate that Salesforce will grow even more strongly in the future than the broader market, whose estimated growth is around 15 percent per year. In my opinion, revenue growth in the range of 20 to 25 percent in the next few years is quite plausible.

How profitable is Salesforce?

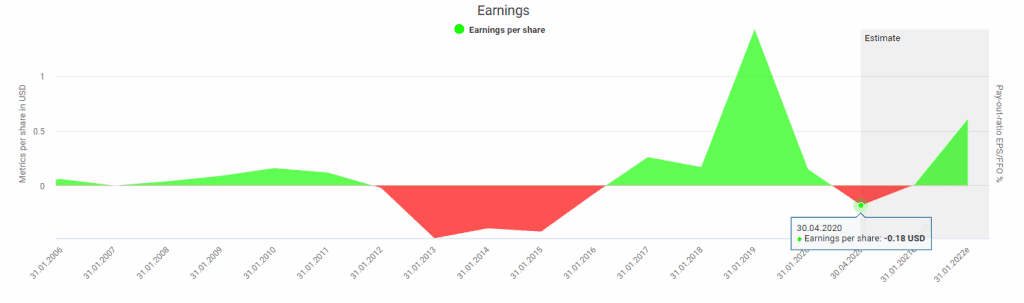

As shown in our Amazon analysis, it can be part of a rapidly growing company’s DNA to make little or no profit, which is also true for Salesforce, whose reported earnings per share are very erratic and sometimes even negative.

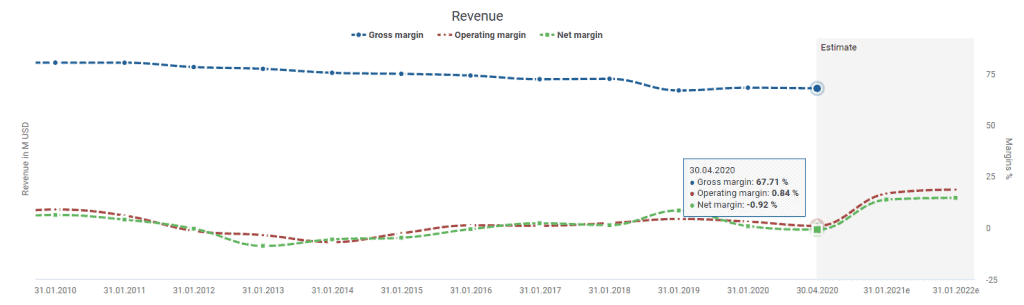

For companies in early stage or strong growth phase it does indeed make little sense to prioritize profit maximization over investments. Nevertheless, you should make sure that the business model is capable of generating profit. A castle in the air that generates revenue and cash flow but still fails to become profitable is hardly suitable as an investment. In this respect, Salesforce’s gross margin is almost 70 percent, which strongly indicates that the company is fundamentally profitable but has high overhead costs, resulting in very low, sometimes negative, operating, and net margins.

Such low margins are not unusual and widespread in the cloud computing market and, for me, no reason to refrain from investing in Salesforce in general. Even the internet giant Alibaba is accepting falling profits to push its cloud business against the top-dogs Amazon and Microsoft.

Is the Salesforce stock overvalued?

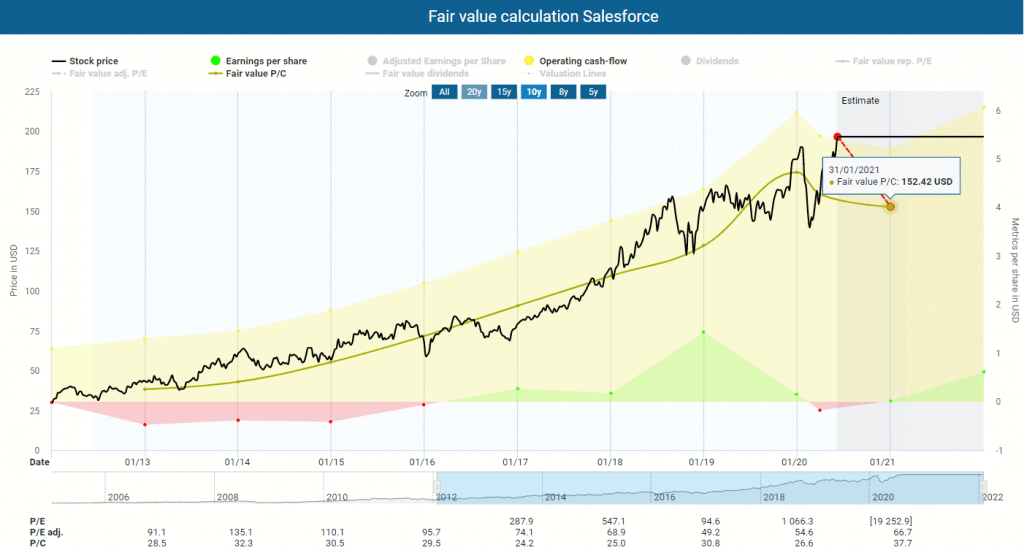

The stock price benefits massively from the company’s excellent position on the market and its growth prospects. It does not look as if Salesforce will leave its successful path in the medium term. So it seems clear that you won’t get Salesforce as a bargain. However, the question is whether the valuation is still appropriate or whether the stock now seems completely overpriced. As with Amazon, you should forget about using profit-based figures such as the P/E ratio because looking at profits is not helpful. Salesforce, like Amazon, prefers to put every cent into future growth and doesn’t think about accumulating capital or paying a dividend to its shareholders.

The result is a sometimes absurdly high P/E ratio, which could well be in the four-digit range. I recommend that you should instead look at the operating cash flow of such companies. As you can see in the dynamic valuation below, the Salesforce stock seems to be overvalued measured by cash flow. With a fair share price of $152 based on historical cash flow, the current price has about 20 percent downside potential.

A Price to sales ratio of over 9.2 indicates an overvaluation in the double-digit percentage range compared to the historical 3-year median of 8.3. The current overvaluation is mainly due to the recent rally after the COVID 19 crash. However, in the course of the crash and previous years, there were repeatedly minor time windows in which the stock returned to its fair value measured by the historical cash flow or even fell below it. Besides, cash flow is expected to fall slightly in the current fiscal year due to the Corona crisis, which is why I do not rule out that the stock price will return to its historically fair value in the medium term.

Salesforce Stock: Buy after a setback!

Although the Salesforce ticker on the New York Stock Exchange suggests otherwise, the company did not create the CRM market, but CEO Marc Benioff has turned the market upside down and taken it to a whole new level. He made this possible by focusing on the cloud early on and offering a range of easily scalable products and services. Beyond that, the Salesforce stock fundamentally fulfills all the characteristics of a growth company such as Amazon: No dividend, hardly any profit, and notoriously overvalued.

However, you might wait for a price setback of the Salesforce shares. It wouldn’t be the first time the stock returned to its fair price. If you want to buy the stock today, you can buy in tranches and keep some powder dry to buy it at a more reasonable price.

1 Comment

Great post! For unparalleled market insights and research resources tailored specifically to the market research industry, explore Stats N Data (https://www.statsndata.org). Our platform offers invaluable market intelligence across diverse domains, empowering businesses with actionable insights that drive success. Looking forward to more engaging content from you!