Nestle stock – Increasing margins for your portfolio

April 28, 2020

Tencent Stock – Chinese Dragon For Your Portfolio?

May 11, 2020Apple stock – despite high stock price a buy?

| Apple Stock | |

| Logo |  |

| Country | USA |

| Industry | Technology |

| Isin | US0378331005 |

| Market Capitalization | 1280,4 billion USD |

| Dividend Yield | 1.1% |

| Dividend Stability | 0.90 (max. 1.0) |

| Earnings Stability | 0.95 (max. 1.0) |

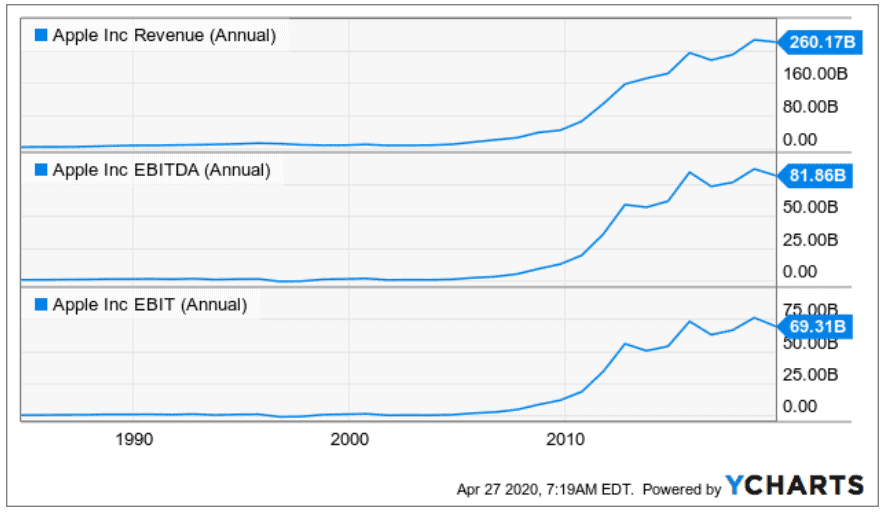

The apple stock is one of the big winners of the last bull market. After the great recession of 2009/2010, Apple has entered into substantial growth. The company now has an annual turnover of USD 260 billion and an EBITDA of around USD 81 billion.

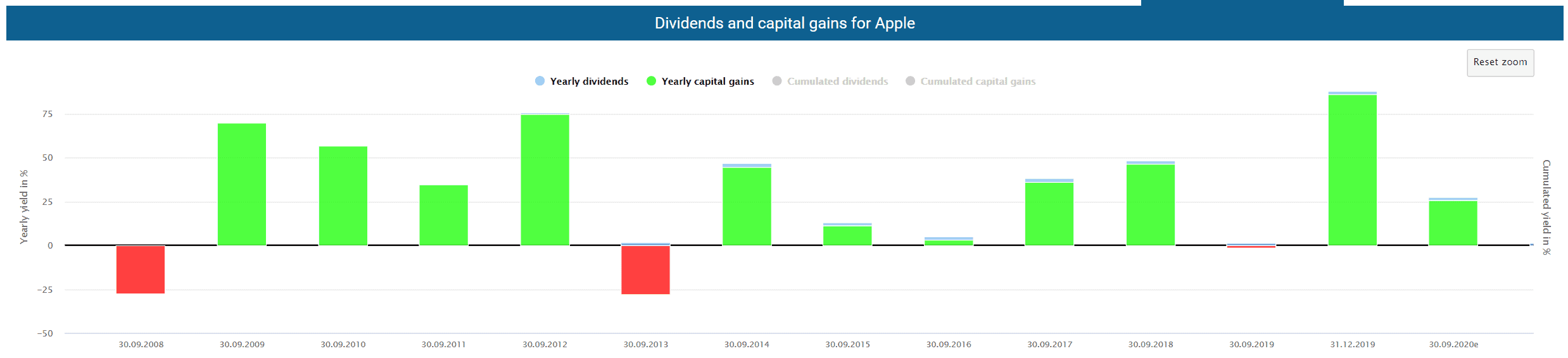

Of course, investors also benefit from this. In 2019, Apple shares gained 86 percent in value (excluding dividends). This was the best year for investors since the end of the great recession. Besides, there have only been two years of losses since 2008, but four years with significantly more than 50 percent annual price gains:

And the success story does not seem to be over yet, as there are still a number of bullish indicators. The high P/E ratio should not necessarily unsettle investors. An isolated consideration of this indicator without taking other factors into account could lead to false conclusions. Apple is certainly not cheap, but in the end, the decisive factor is whether investors are willing to pay a little more money for quality or not. And the quality is there.

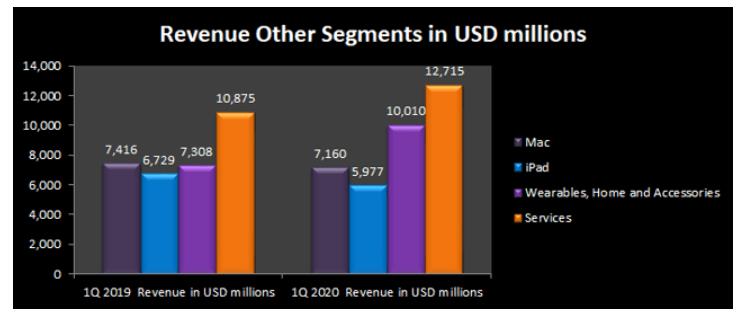

Service segment as a revenue machine

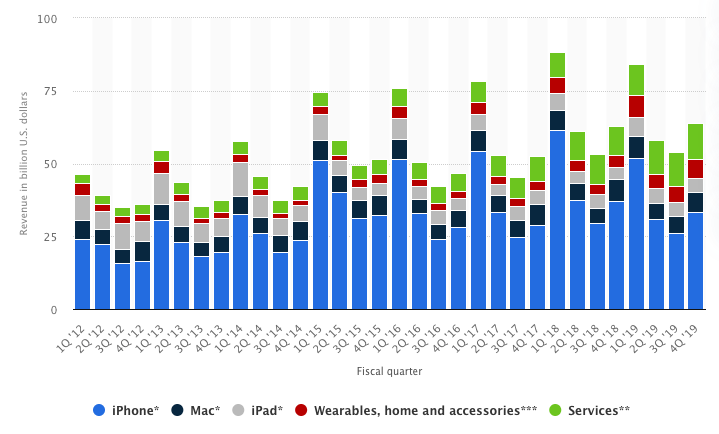

Apple is increasingly succeeding in moving away from the iPhone as the dominant revenue driver and is increasingly focusing on its service segment. However, the iPhone is still responsible for about half of all sales:

Nevertheless, the share of the high-margin service business is growing steadily. Apple is endeavoring to win new customers with the service segment. The service segment, which includes the App Store, cloud solutions, and Apple Pay, is now the second most important business segment in terms of sales for the Cupertino-based tech company. From Q1 2014 to Q1 2020, sales have almost tripled. Most recently, only the “Wearables” segment, which includes iWatch and AirPods, among others, recorded stronger growth.

Apple has made its service offerings available to even more people. As the company has announced in a press release, it will launch the App Store, Apple Arcade, Apple Music, Apple Podcast and iCloud in the following countries:

- Africa: Cameroon, Côte d’Ivoire, Democratic Republic of the Congo, Gabon, Libya, Morocco, Rwanda, and Zambia.

- Asia-Pacific: Maldives and Myanmar.

- Europe: Bosnia and Herzegovina, Georgia, Kosovo, Montenegro, and Serbia.

- Middle East: Afghanistan (excluding Apple Music) and Iraq.

- Oceania: Nauru (excluding Apple Music), Tonga, and Vanuatu

Apple is bringing Apple music to even more countries, especially in Africa and Latin America. Why is this good news for investors? Well, firstly, this raises hopes for even more substantial revenue growth. The timing for this is also conceivably well-chosen because COVID-19 means that many people spend an above-average amount of time at home and are therefore looking for entertainment. Besides, every single one of these service offers strengthens direct and indirect network effects. The more services Apple offers via its platform, the more powerful the company becomes, and the fewer customers will resort to alternative offers.

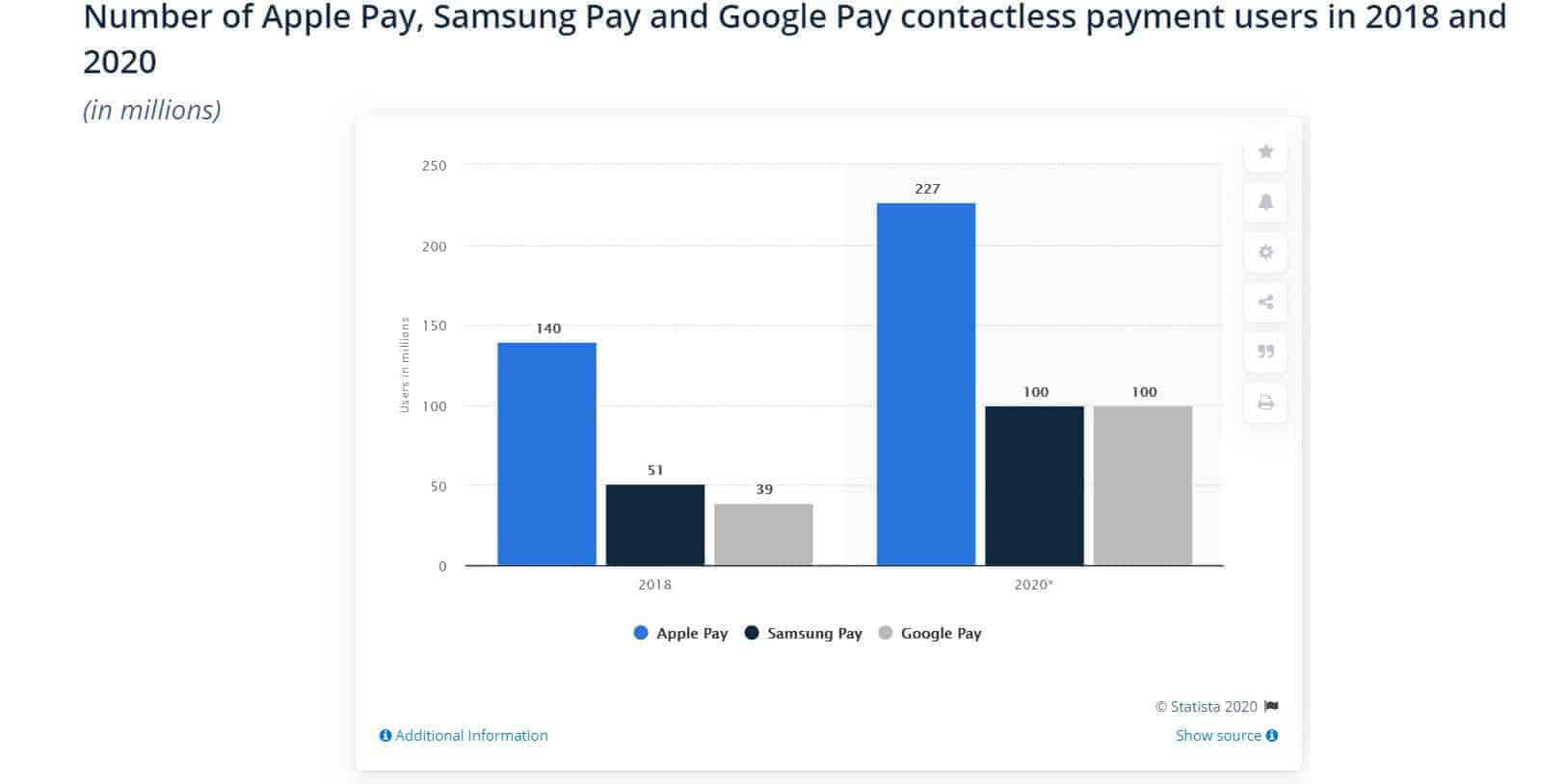

Apple Pay is an excellent example of such effects. The more people use Apple Pay, the more merchants will offer payment methods for Apple Pay, and the more merchants offer Apple Pay, the more likely customers will also use Apple Pay, as they tend to be able to pay in more stores than with other services. Even though other providers of contactless payment services will of course also get their share of this mega-market, Apple has been able to increase its lead over, for example, Samsung Pay and Google Pay in absolute figures:

Apple’s market dominance may be as a problem

That such network effects can be powerful can be seen in Amazon’s business model and its position in the market. And indeed, from an economic perspective, network effects lead to market power tendencies and foreclosure effects in the affected markets. The consequence is simple: monopolies emerge. Such monopolies are excellent for investors. They act as a protective moat for the entire business and are, therefore, a particularly strong buying criterion in the sense of value investors.

The problems for Apple arising from its market position are mainly regulatory. Competition authorities, in particular, are focusing on the company. While companies with great market power are not a threat to competition in themselves, companies with market power such as Apple have a special responsibility not to abuse this market power. And regarding Apple Pay, Apple may have gone too far because Apple is subject to antitrust investigations concerning its “Near Field Communication” (NFC) interfaces (which allow contactless payment). Apple will very likely have to provide access to these interfaces so that other providers such as Amazon or Google could also offer payment services for Apple hardware. In Germany, a law to this effect has already been passed (virtually overnight).

Of course, regulatory requirements could stimulate competition somewhat. But investors should consider the following. Users of Apple hardware will, in the majority of cases, also use Apple services. In this respect, there are extreme lock-in effects. Once you use a payment system, you will not easily give up using it and switch to another provider. I, therefore, think that (if there is a worldwide opening of the interface at all), the negative consequences are manageable and will be significantly compensated by the further growth of Apple Pay.

The new but well-known pricing strategy

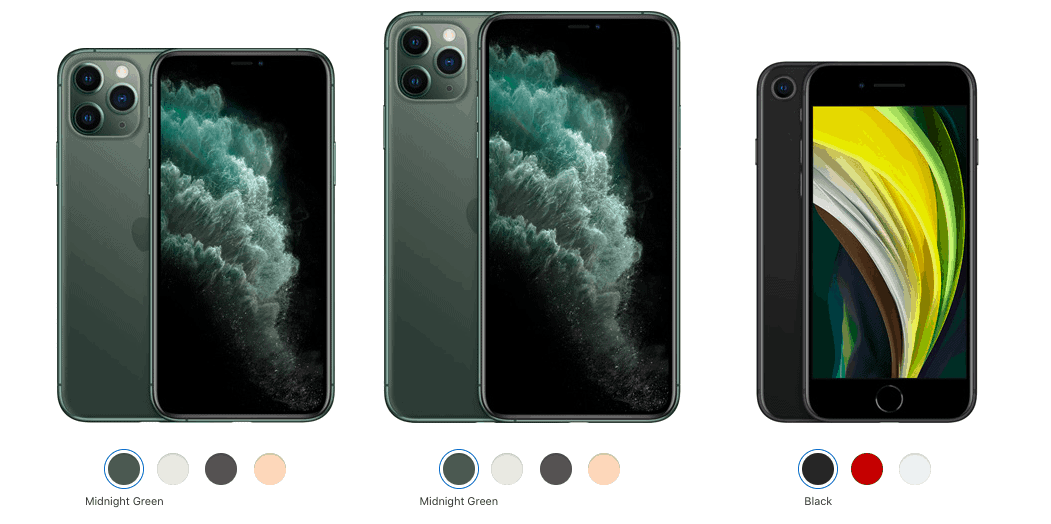

Furthermore, there is another piece of the puzzle that underlines that Apple is pursuing a sensible and sustainable strategy. Apple has introduced the new iPhone SE. The phone is said to cost only 400 US dollars and is extremely cheap by Apple’s standards. This is the second time Apple has brought a relatively inexpensive iPhone onto the market after the iPhone SE from 2016.

I think this is an excellent decision because Apple is pursuing a simple but extremely effective pricing strategy. The company is deviating from its usual strategy of initially higher and over time falling prices (so-called “skim prices”) and replacing this method with lower prices (so-called “penetration prices”). As a result, more consumers can afford Apple hardware and more consumers can use Apple services placed around the hardware. Hence, Apple is moving its cash cow away from hardware towards software where the grass grows faster. With the new iPhone SE Apple will gain market share over its competitors (especially Samsung, Huawei, Sony etc.). In addition, the new SE also offers an opportunity for Apple to promote its own streaming service, as this is included for one year free of charge in the purchase of the iPhone SE, as usual.

Theoretically, there are some risks for Apple. Besides a low margin, the brand value could be diluted by “cheap” products from the same company. But I think that the advantages outweigh the disadvantages. Concerning brand dilution, I don’t see any significant problems. For example, the iPhone SE differs from expensive phones in terms of color and case design.

More importantly, however, Apple can also expand its market share vertically if it manages to attract more people to its services with the cheaper iPhone. Many people were kept away from the services because of the expensive hardware prices. Besides, the new SE also offers an opportunity to promote Apple’s streaming service, as this is included in the purchase of the iPhone SE for one year free of charge as usual.

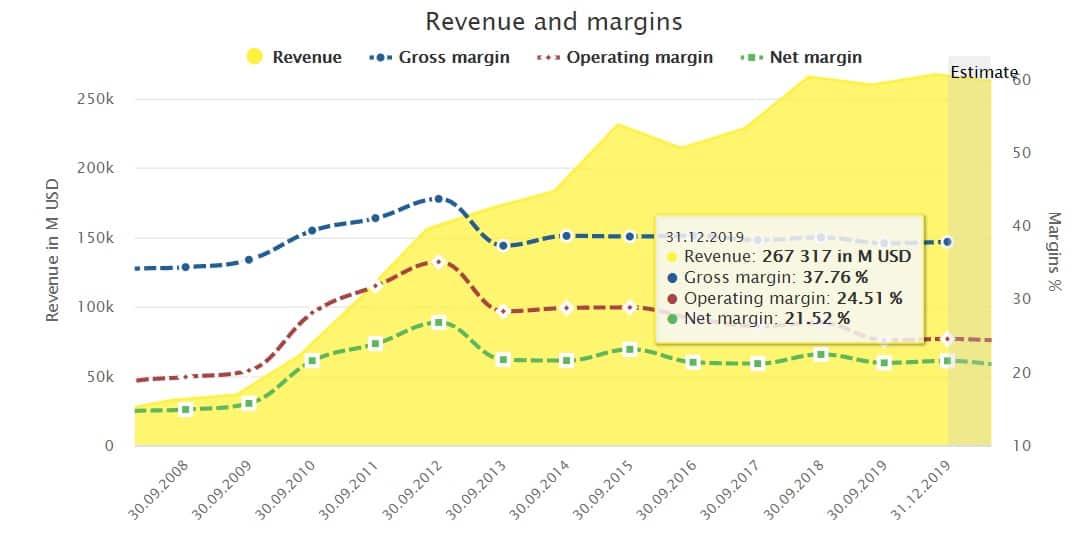

I am also not afraid that this approach will be at the expense of the margin. After all, Apple has managed to keep its margin stable over the last few years, despite considerable growth in sales. This can be clearly seen from the following chart:

As you can see, the gross margin, the operating margin, and net margin are consistently stable within a healthy corridor. A single cheap iPhone SE in the entire product portfolio will not significantly affect the excellent margin, especially since the comparatively high margin in the growing service area would compensate for possible declines.

In this respect, Apple is exceptionally well-positioned operationally. I expect that revenues will continue to increase in the medium term without sacrificing profitability.

Apple stock is not expensive

Assuming a profit of 12.38 US dollars for 2020, Apple has a P/E ratio of about 22.2, which initially seems rather high. In particular, it must be taken into account that the hardware business is likely to have suffered badly due to COVID-19, closed stores, and reluctant consumers. In this respect, the current P/E ratio could be set too low. And indeed, the current price continues to rank above the fair value P/E ratio. The difference to the fair value P/E ratio (red line) even indicates a downward potential of around 20 percent.

However, investors must keep in mind that Apple is both a growth and a value company. It has enormous market power and is equipped with extreme financial resources to be able to invest in any business area in which it wants to operate (keyword: Apple Car). Investors have to pay a premium for such quality.

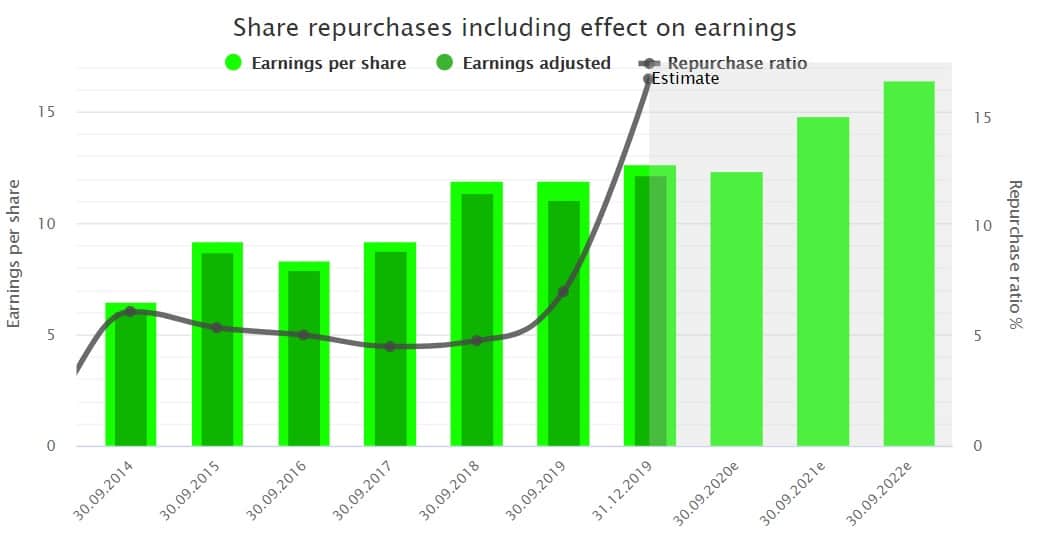

Besides, Apple makes extreme use of share buybacks. So if you want to sell your shares to take your profits, Apple may buy the shares on the other side so that your future gains and dividends are distributed among the other investors.

If Apple maintains the pace of its share buybacks, this would result in a repurchase volume of 16.7 percent of all outstanding shares. Even if the size of buybacks should decrease due to the uncertainties in the markets, I expect Apple to continue to make heavy use of share buybacks in the future.

Investors should also note that Apple is not that overvalued compared to other companies. Microsoft, Visa, and NVIDIA, in particular, are companies that are also growing strongly but also have a high P/E ratio as you can see from their 5-year median:

Of course, here too, investors should analyze these metrics in the overall context (as always). However, they can see here that the market is trading companies with a strong market position and excellent prospects with a premium. Overall, I think that Apple can meet the expectations in the P/E ratio for the reasons mentioned above, although there may be some uncertainties in the short term due to COVID-19.

Conclusion: The Apple stock as a solid anchor for every portfolio

Although you may have to pay a premium, Apple remains a possible anchor company for any broadly diversified retirement portfolio. Anchor companies are companies where you should avoid any market timing as much as possible and instead make use of the cost-average effect. Furthermore, the P/E ratio is supported by a solid business foundation and an excellent balance sheet.

As far as there could be worse developments in connection with COVID-19 after all (currently, however, the tendencies are more likely to return to normal), this could, of course, hurt the price. But if in doubt, I’d rather do an extra lap in the valley than miss the summit – a slowly but steadily rising dividend yield of currently around 1 percent and a payout ratio of around 25 percent complete the overall picture of thoroughly reasonable investment.

If you look for stocks with long-term profit growth to benefit from growing dividends and capital gains, register now. Basic membership is free of charge.

Excellent tool for investors looking for quality stocks in a fast and easy manner – TRADERS’. Magazine for traders and investors

1 Comment

[…] have outsourced their hardware production entirely are, for example, Advanced Micro Devices (AMD), Apple, Nvidia or Qualcomm, for whom we have already published free stock analyses. Other customers such […]