Winner and loser stocks January 2019

February 1, 2019

Are dividends safe? Analyst estimates

February 5, 2019Every investor’s nightmare is a dividend cut. It is the final oath of revelation. Now you must admit that your investment was a mistake. As long as the dividend remained constant or even increased, the falling stock price could be attributed to the whims of the market. True to the motto: What do I care about the unpredictability of the market if the cash flow is good?

Like everywhere in life, there is no guarantee on the stock market. But there are things you can do to reduce the probability of a bad awakening to a minimum. Four simple steps are enough to keep dividend payments mostly save. The first step is to consider the payout ratio.

Video to payout ratio

A classic: the payout ratio

The payout ratio describes the coverage of dividends by profits. Two variants exist. Here is how it’s done most often:

Payout ratio % = Dividends / Earnings

However, dividends are usually paid out as cash dividends. And as the word “cash” suggests, it leads to the money flowing out of the company. Earnings, however, are a balance sheet item, and earnings rarely correspond to the actual amount of money received by the company. For example, if the company has a lawsuit on its hands, it will set aside reserves in the event that it loses the case. The earnings decrease by the amount of the provision without the money leaving the company (at least not yet). If the company wins the lawsuit in the following year, it dissolves the provision that is no longer necessary. The earnings increase without even one cent flowing into the company. Another example of a drifting apart of profit and cash flow are investments activated in the balance sheet, which have to be paid in full on acquisition, but in the year of acquisition only charge the profit with the depreciation amount.

To cut a long story short: the better variant for calculating the payout ratio replaces earnings with free cash flow. This is the amount of cash that the company actually received after deducting all investments. This amount of cash is available to the company for the distribution of dividends:

Payout ratio % = Dividends / Free-Cash-Flow

On the other hand, an investment stop in the context of a business crisis increases the free cash flow. However, it would probably be the wrong way to pay out the money saved in this way as dividends, because it would no longer be available for future investments needs.

Instead of either-or one can also pay attention to both payout ratios. If both payout ratios are in the safe range, then all the better.

And how high may the payout ratio be?

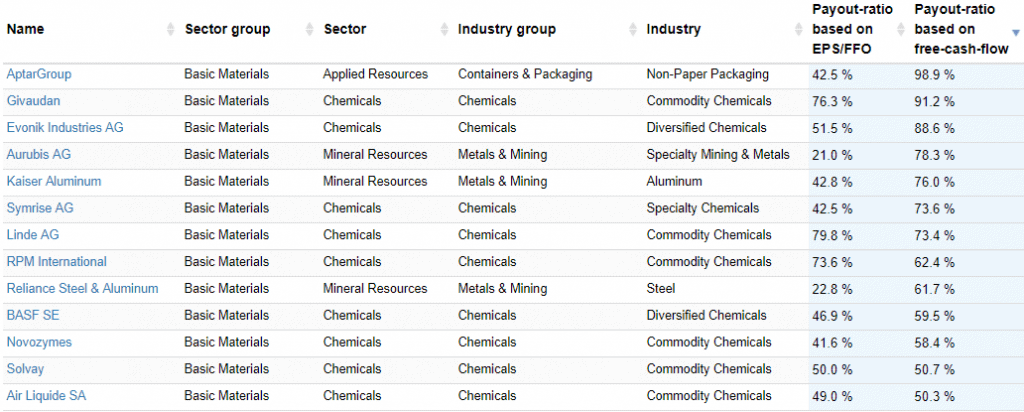

This varies from industry to industry and depends, among other things, on how capital-intensive and competitive the industry is. The following table gives a rough idea of which payout ratios and dividend yields are common in which sectors:

| Sector | Average Payout Earnings |

Average Payout FCF |

Average Dividend Yield |

| Basic Materials | 43.9% | 62.7% | 2.80% |

| Consumer Cycl. | 45.6% | 57.7% | 3.10% |

| Consumer NonCycl. | 55.7% | 56.6% | 2.50% |

| Energy | 60.8% | 84.1% | 4.20% |

| Financials | 55.8% | 69.3% | 4.30% |

| Healthcare | 48.7% | 50.6% | 1.90% |

| Industrials | 40.2% | 58.9% | 2.20% |

| Technology | 39.1% | 40.9% | 2.00% |

| Telecommunication | 74.6% | 66.1% | 4.60% |

| Utilities | 69.9% | 97.5% | 3.30% |

The payout ratio based on free cash flow is higher compared to earnings in most industries, because investments make a full impact on cash flow, but only partially on earnings.

In addition, there are large differences between the individual industries, whereby this grouping is very rough and serves only for clarification. A four-level industry hierarchy is available on DividendStocks.Cash. This makes it easier to determine which payout ratio is common in which sector hierarchy.

The image below shows the sector hierarchy for different companies in the financial sector including payout ratios.

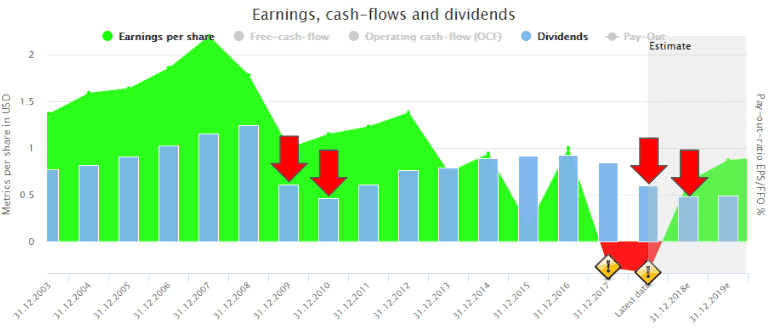

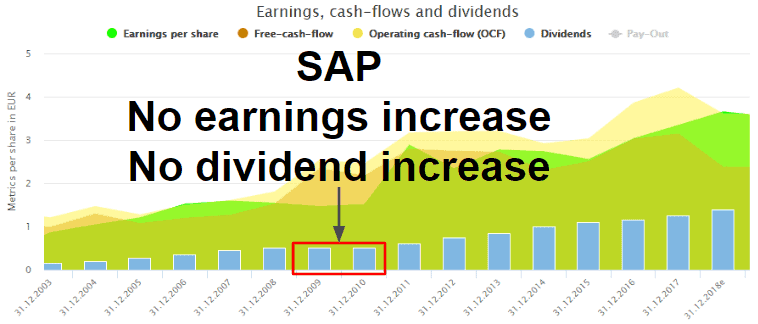

The payout ratio in the course of time

The payout ratio of a company may change over time. If it has remained constant in recent years, this suggests a secure dividend. If, on the other hand, the payout ratio increases permanently, this may indicate that further dividend increases will become less secure.

The payout ratio is determined by the evolution of earnings or free cash flow and by the the dividend policy. Some companies like SAP or Henkel determine the dividend based on the payout ratio.

SAP determines the dividend amount based on payout ratio (currently 40% of earnings after taxes)

For other companies, particularly in the US, the annual increase of the dividend is the primary objective. In leads to symbolic dividend increases of one cent, even if a dividend cut would make more sense from an economic point of view.

Interim conclusion

Instead of establishing a rigid limit for the payout ratio, one can consider what payout ratio is common in the respective industry. If the payout ratio of the stock analysed is significantly higher than the payout ratios of its competitors, caution is advisable.